Ledgible Account

please use to the links below to sign in:

TAX FOR INDIVIDUALS

Secure and Automated DIY

Crypto Tracking & Tax Reporting

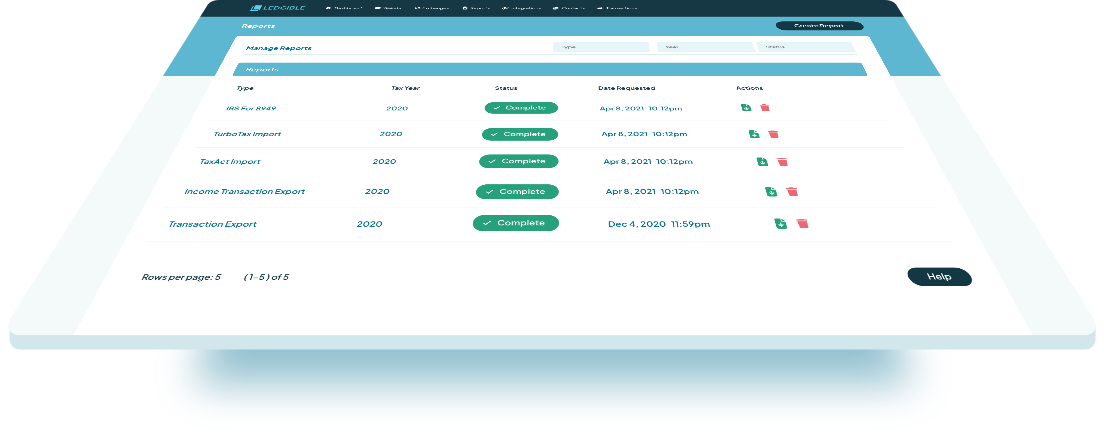

Ledgible ensures that your tax burden is minimized, even in technically complex scenarios like airdrops, hard forks, or NFTs. No more manually compiling crypto data come tax filing season.

You File with Confidence

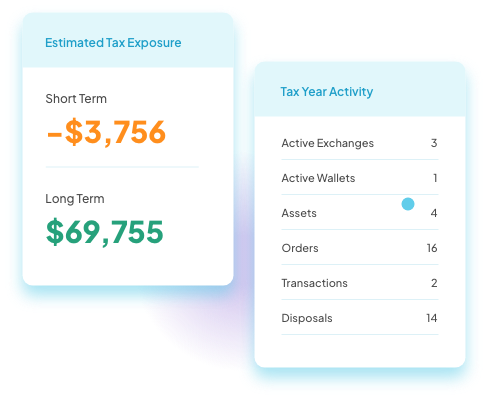

& Crypto Portfolio Dashboard

Current Year Tax Planning & Cryptocurrency tracking allows you to monitor your crypto activity during the year and provides you with your tax exposure based on asset holdings and disposals. Easily track all of your crypto holdings in one place, like holding from Binance, Coinbase, Crypto.com and more.

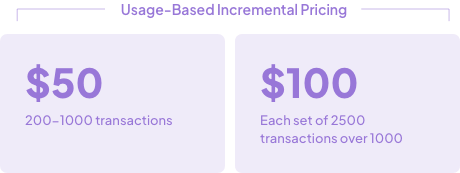

Ledgible Crypto gives you a “source of truth” for your crypto investments and for crypto tax prep. Crypto tracking with Ledgible is 100% free throughout the year - only pay for reports come tax season.

& Fee Accounting

Most crypto tax products don’t go far enough when aggregating disparate crypto transaction data.

Ledgible’s unique on-chain capabilities allow you to automatically trace when holdings move between crypto wallets and exchanges with cost-basis visibility. Additionally, you can account for fees ensuring maximum accuracy.

Explore Our Solutions

Explore the Latest Crypto Content

Industry leading support for every crypto tax scenario

Ledgible maintains an industry leading knowledge base that walks you through every intricate scenario you might encounter in the crypto tax process. If we don’t have an article on our knowledge base for your exact question, we have knowledgeable support staff available 24/7 who work with users to solve any challenge they face.

Explore the full range of solutions that Ledgible offers to support Enterprises, Institutions, and Professionals