Virtual currency and crypto tax reporting continue to be top enforcement priorities for the IRS. With the virtual currency question moving to the first page of Form 1040, is your firm prepared to serve some of the 25 to 50 million taxpayers who will need help reporting cryptocurrency transactions to the IRS?

The IRS is prioritizing rooting out cryptocurrency tax evasion in the coming years. At a federal Bar Association presentation on fraud enforcement priorities, Damon Rowe, Director of the Office of Fraud Enforcement at the IRS, announced “Operation Hidden Treasure.” This initiative includes a dedicated team of criminal investigators trained in virtual currency tracking. They’ll be looking for telltale signs of cryptocurrency activity to ensure that all U.S. taxpayers pay appropriate taxes on their crypto transactions.

This white paper provides an overview of the challenges crypto tax provides for professionals and best practices for integrating it into your existing workflows. We’ll explain how your firm can implement an end–to–end crypto workflow to maintain efficiency, minimize risk, improve the client experience, and automate data entry into your tax software.

Overview of Cryptocurrencies

Cryptocurrency is decentralized digital money designed to be used over the internet. Bitcoin and Ethereum are the most well–known cryptocurrencies, but there are thousands more out there.

Cryptocurrencies are appealing because they allow people and institutions to transfer value online without intermediaries like banks or payment processors. They’re also usually not issued or controlled by any government or other central authority.

ll cryptocurrency transactions are recorded on a blockchain. Think of the blockchain like a bank ledger keeping track of all the transactions. The cryptocurrency blockchain is distributed across the network participants, and those participants work together to keep it organized.

There are many ways people can transact with cryptocurrencies. They may buy and sell goods and services online using cryptocurrency or invest in cryptocurrencies. These types of transactions result in capital gains.

People may also earn income from staking and mining. Staking involves holding funds in a cryptocurrency wallet to support the security and operations of a blockchain network. Mining is the process in which transactions between users are verified and added to the blockchain public ledger. These are both behind–the–scenes work necessary to run a blockchain. The people doing this work are usually paid in cryptocurrency, which is taxable as ordinary income.

Wallets vs. Exchanges

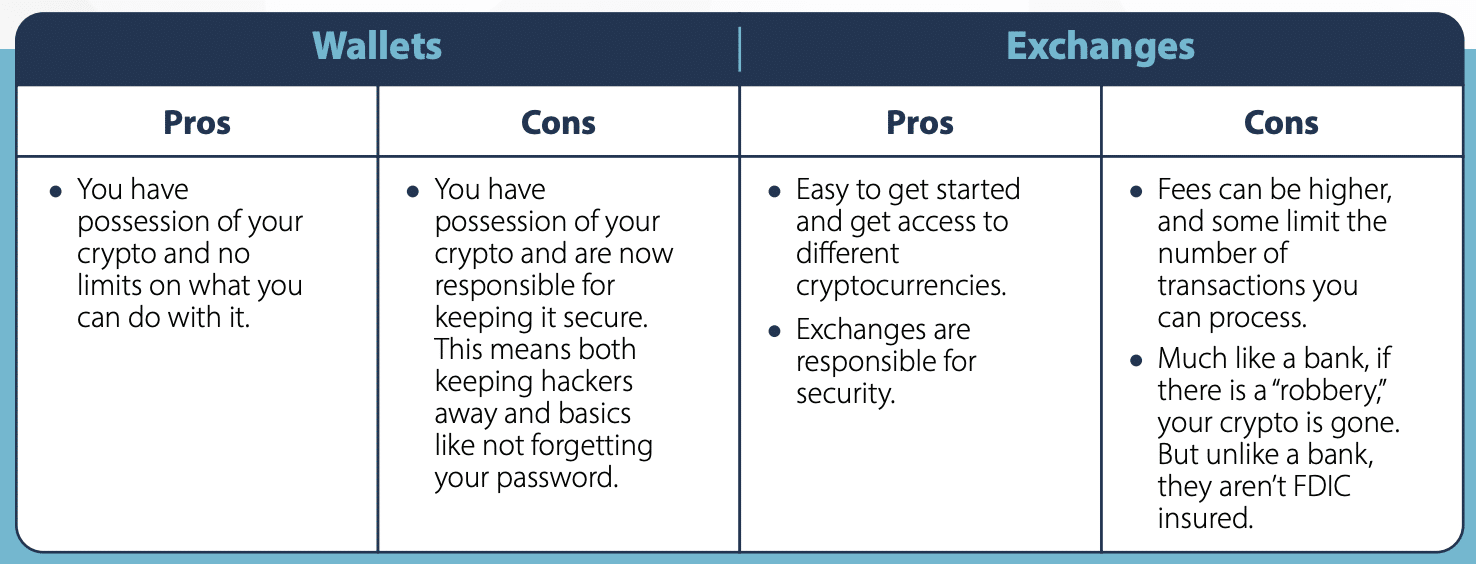

A common source of confusion for people new to the cryptocurrency arena is wallets versus exchanges. Some people even use the terms interchangeably. An exchange is a service or platform that enables clients to trade cryptocurrencies for other resources, such as other cryptocurrencies, U.S. dollars, or other currencies.

Think of exchanges like banks. They use custodial accounts to hold their user’s funds and then track them on an internal ledger to allow for trading and exchanging funds. Trades are made “off-chain,” and no actual crypto is transferred as a result of these trades. They’re only making changes to the ledgers.

There are over 300 actively tracked exchanges worldwide, and they handle anywhere from $8 billion to a few thousand dollars in daily transaction volume. Coinbase, which is in the process of filing for an IPO, is the largest, with 43 million active users on its platform.

If the blockchain is the overall ledger, your public key is the account number and the private key is your password or PlN needed to access your account. Public and private keys are stored and encrypted in a cryptocurrency wallet. Wallets are used to track ownership, receive or spend cryptocurrencies. They don’t store the cryptocurrency; they store the private key used to sign transactions.

Wallets may be “hot” or “cold.” Hot wallets are connected to the internet and are more user–friendly but less secure. They’re good for day-to-day transactions. Cold wallets are not connected to the internet and are harder to use but more secure. They’re good for long–term holding.

There are a variety of different wallet types:

Online wallet. These are run on the cloud and can be accessed from any device with an internet connection. Mobile wallet. These are apps that can be downloaded and installed on a phone or tablet.

Desktop wallet. This is software that can be downloaded and installed on a computer or laptop. Hardware wallet. This refers to a device (typically a USB drive) in which a users’ private keys are stored. Paper wallet. This may be a printed sheet of paper with public and private keys. The user may print this information and put it in a safe or safety deposit box.

How cryptocurrency transactions are taxed

Cryptocurrency is also referred to as virtual currency, but according to the Financial Crimes Enforcement Network (FinCEN) and the IRS, they’re not a true currency. From an IRS perspective, cryptocurrencies are property, and all the tax treatments of property come into play.

For more information on the general tax principles that apply to virtual currencies, refer to the following IRS Publications:

- Publication 525, Taxable and Nontaxable Income, for more information on miscellaneous income from exchanges involving property or services

- Publication 526, Charitable Contributions, for more information on charitable contribution deductions

- Publication 544, Sales and Other Dispositions of Assets, for information on capital assets and the character of gain or loss

- Publication 551, Basis of Assets, for information on the computation of basis

- Publication 561, Determining the Value of Donated Property, for information on the appraisal of donated property worth more than $5,000

Types of Cryptocurrency Transactions

Your firm’s clients can be involved in several different cryptocurrency transactions, and each has its own tax rules.

Payment for services

Suppose an employer gives an employee virtual currency (such as Bitcoin) as payment for their services. ln that case, the employee must report the currency’s fair market value in their taxable income. The fair market value of virtual currency paid as wages is subject to federal income tax withholding, FICA and FUTA taxes and must be reported on form W–2.

Trade or business income

For taxpayers who mine virtual currency as a trade or business, the net earnings from self–employment resulting from that activity constitutes self–employment income and is subject to self–employment tax.

Taxpayers who receive virtual currency as compensation for services in a trade or business must report the income as they would report other income of the same type, such as W–2 wages on form 1040 or services on Schedule C.

Businesses that dispose of a virtual currency that they held for sale to customers must account for the disposal the same way they would account for other inventory.

Sales and dispositions

The one most firms are likely to see is sales and dispositions. lf a client exchanges crypto for goods or services sells crypto or trades one type of crypto for another (such as trading Bitcoin for Ethereum), those are capital gain and loss transactions.

Determining these transactions’ cost basis is one of the biggest challenges you’ll face as a preparer. According to IRS's Virtual Currency FAQs:

- The basis of virtual currency purchased with real currency is the amount spent to acquire the virtual currency, including fees, commissions and other acquisition

- The basis of virtual currency received for services provided is the fair market value of the virtual currency, in

U.S. dollars, when the virtual currency was received.

- The basis of property received in exchange for virtual currency is its fair market value at the time of the exchange.

Keep in mind that nothing about the basis or the crypto’s actual value is stored on the blockchain. All the blockchain has is the quantity. CPAs doing this manually will need to find an online source or record to find the currency’s value at that time.

Donating virtual currency

Clients may also donate virtual currency. To calculate their charitable contribution deduction, they must take the virtual currency’s fair market value at the time of the donation if they’ve held the virtual currency for more than one year. lf they held the cryptocurrency for one year or less at the time of the donation, the deduction is the lesser of the taxpayer’s basis in the virtual currency or the virtual currency’s fair market value at the time of the contribution.

Transfers between exchanges and wallets (on-chain)

Taxpayers don’t have to recognize a gain or loss when transferring virtual currencies between wallets or exchanges, but the transaction may still appear on an information return.

Transfers between different wallets and exchanges can also complicate basis tracking as you will need to find the original transaction to determine the basis and account for any transfer fees.

Exchanging one crypto for another

Many crypto enthusiasts frequently exchange one form of crypto for another, such as exchanging Ethereum or Bitcoin or vice versa. That’s two transactions, according to the IRS. The client would need to report the sale of one and track the basis for another purchase.

Information needed from taxpayers

When a client comes to you and says they have cryptocurrency transactions, the first thing you need to do is gather information from them to account for and report taxable transactions properly. But there can be several challenges when gathering that information.

Information reporting. lt would be nice to get a 1099–B showing the proceeds and basis for each cryptocurrency transaction. However, what the client is likely to provide, if anything, is a 1099–K or 1099–MlSC showing gross proceeds. The IRS and cryptocurrency exchanges haven’t yet figured out how to handle information reporting for cryptocurrencies.

Unfortunately, 1099–K and 1099–MlSC don’t provide any beneficial information. They don’t consider cryptocurrency moving off one exchange into another or to an on-chain wallet – it’s reported as a taxable transaction and included in the proceeds on the 1099 form. Currently, those firms are just a big arrow pointing the lRS to the taxpayer. lt’s up to clients to provide the detailed information you need to calculate their crypto taxes.

It’s a good idea to discuss the possibility of receiving an IRS notice based on these informational reports with your clients. lf they do receive a notice, it’s helpful to have a way to easily reconcile the 1099 to taxable vs. non–taxable transactions.

Exchanges. Roughly 80% of people who own cryptocurrency are holding it on an exchange, and there are hundreds of exchanges around the world. The major exchanges provide some form of transaction report – usually in an Excel spreadsheet, PDF or CSV file. The trouble is, each exchange has its own format. They may even use different symbols for the same cryptocurrency. For example, one may refer to Bitcoin as BTC while another calls it XBTC.

A typical report will include information about the transaction type, proceeds, fees, and where the cryptocurrency went. What’s typically not there is cost basis or where it came from.

On-chain transactions. All transactions are written into the blockchain. With a client’s public key, you can see all the transactions over the lifetime of the blockchain. However, clients may be using wallets. While cloud and desktop wallets may have an export option, app, hardware and paper wallets typically don’t. Screenshots or manually maintained spreadsheets may be all the taxpayer can provide.

ln most cases, you will receive a mixture of 1099s, spreadsheets and screenshots. lf you’re using scan and populate software, it will recognize the 1099s, but information from form 1099–K or 1099–MlSC will flow into Schedule C or the other income on Schedule 1 rather than treating it as a gain or loss. This can overstate ordinary income and understate capital gains if not corrected. And, of course, the software won’t be able to automate anything from screenshots or spreadsheets.

Software tools for Crypto Taxes

There are several consumer-grade cryptocurrency tracking solutions out there that your clients may use, but these aren’t ideal for firm use because:

- There is no client management, real-time client collaboration or team management. Your crypto clients may be high net worth individuals, so it’s important to control who has access to their data.

- They’re not SOC Audited

- They don’t consistently account for fees. The instructions for form 8949 are very clear. Taxpayers need to deduct the selling expenses from proceeds and add fees for purchasing to basis when calculating a gain or loss on a property transact. But another challenge here is that sometimes fees are taken out of the client’s crypto. For example, if an exchange charges a $3 transaction fee, it may use a portion of the client’s Bitcoin to cover the fee rather than taking the fee in U.S. Dollars. This results in another taxable event: trading virtual currency for a service. Fees can be significant. If you’re not accounting for them correctly, gains can be overstated, causing your clients to pay more in tax than they should.

- They don’t integrate with professional 1040 tax solutions.

These limitations often result in a lot of unpaid work for the CPA trying to sort out a client’s transactions, account for fees, and ensure all the transactions are correctly reported on the client’s tax return.

Ledgible Tax Pro is the only SOC 1 & 2 audited crypto platform designed specifically for professionals. lt offers the following features and functionality.

Collaboration. You & your clients can use the system simultaneously to review transactions or discuss year–end planning strategies. You can help them directly on their behalf as a valueadded service.

Workflow. The integrated workflow provides visibility into exactly where each client is in the process. You will know which clients are stuck so you can provide a polite reminder or additional assistance.

Team Management. Tax preparation is a team sport with each member of the firm doing their part. Set up and manage your team or limit access to your firm’s most confidential client information.

Professional Tax Software Integrations. Use certified integrations to seamlessly load crypto tax information into Wolters Kluwer, Drake, lntuit, Thomson Reuters and other professional tax solutions.

Detailed Reporting. Detailed gain/loss, income and gift reporting for compliance, planning and audit defense.

Robust Exchange and Wallet Integrations. Ledgible Tax Pro integrates with all exchanges and on–chain wallets to ensure the client’s data is accurate and up–to–date.

Transaction Matching. The system does the work of matching all of the different transactions and automatically tracing when holdings move between crypto wallets and exchanges. lt tracks cost basis to ensure the client’s tax returns are accurate.

Complete Fee Accounting. Ledgible Tax Pro accounts for fees and allows full wallet/exchange cost basis calculations to minimize taxes owed. This will help your firm clearly demonstrate your value and expertise to clients.

Crypto Tax Planning and Advisory. Ledgible Tax Pro includes unrealized gain/loss tracking by currency, including short/long term breakout. This enables year–round advisory opportunities, including estimates, extensions and year–end tax planning.

Is your firm prepared to seamlessly incorporate cryptocurrency reporting into your tax workflow?

With millions of taxpayers investing and transacting in cryptocurrency, it’s a good time to start marketing your services and establishing yourself as an authority in the space.

However, with the sheer scale of cryptocurrency exchanges, different types of transactions and rules for calculating basis, manually filing cryptocurrency tax returns for your clients can be arduous and convoluted.

Gearing up to offer this service to your clients may seem daunting, but using Ledgible’s platform designed for accounting and tax professionals along with SurePrep’s scan–and–populate solution, can be an enormous boon for your firm and your workflow. You’ll be well on your way to offering more value for your clients and bringing in more revenue for your firm.