Ledgible Account

please use to the links below to sign in:

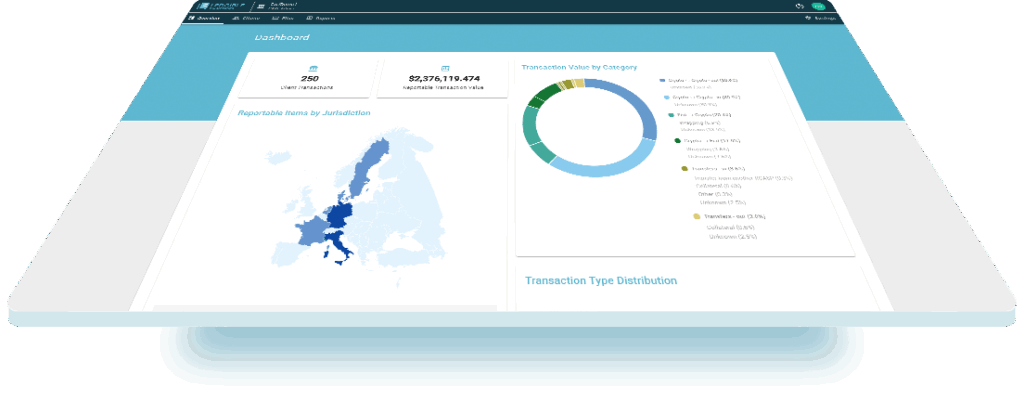

Comprehensive CARF / DAC8 Compliance

Unlike traditional tax reporting regimes, CARF and DAC8 operate on raw transaction-level data exchanged between countries. While blockchains provide transparency, they do not produce tax-intelligible records on their own. Raw blockchain data alone is not enough.

Ledgible integrates directly with global tax information reporting partners, supporting standardized downstream delivery to organizations such as S&P Global and other regulatory reporting networks.

Prepare for Global Crypto Tax Reporting—Now

CARF adoption is accelerating worldwide, and regulatory alignment is expanding rapidly. Institutions that wait will face compressed implementation timelines, elevated compliance risk, and fragmented reporting infrastructure.

Ledgible enables proactive, production-ready CARF & DAC8 compliance — today.