As adoption of cryptocurrencies such as Bitcoin and Ethereum continue to grow in the United States, veteran and novice taxpayers struggle with their crypto taxes. Year-end tax planning conversations are a great opportunity to discuss crypto (or Virtual Currencies as the IRS calls it) with your clients. Just like with traditional investments understanding your client’s activity for the year, before the end of the year, is key to achieving the best result.

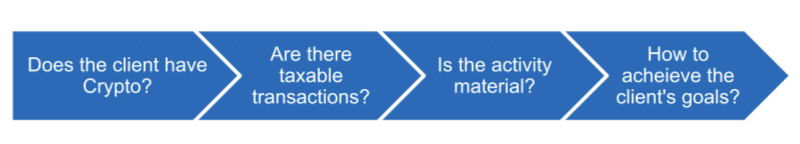

Ledgible developed this playbook in partnership with experienced crypto tax professionals to help you quickly get up to speed. The Crypto Tax Planning Playbook is built around four key questions:

To facilitate this conversation, this guide provides background, checklists and an overview of how Ledgible Tax Pro can make this process simple for both you and your client. In no time at all, you’ll be ready provide existing and new clients a view into their crypto taxes unlike anything they’ve seen before. With this information and the broader knowledge of their tax situation developed through your existing process, you’ll be positioned to provide them a whole new level of value.

Step #1: Does the client have Crypto?

Update your tax planning checklist with the following items

Do you have any Crypto?

The IRS considers all digital assets and cryptocurrencies as ‘Virtual Currencies’ for tax purposes. Examples include:

- Bitcoin (BTC)

- Ethereum (ETH - pronounced ‘E-th’)

- Tether (USDT)

- Ripple (XRP)

Did you include Crypto on prior year returns?

It’s not uncommon for people in crypto to believe they don’t need to include it in their taxes or that the IRS won’t catch them. The IRS has identified this as a top enforcement priority and now is the time to start reporting.

If the answer to the above is ‘No’, there is no need to proceed.

How active with crypto have you been this tax year?

Disposals, exchanges, transfers, sending crypto to a third party, gifting crypto, etc. are all different types of potential taxable events.

Do you have any low or now-worth holdings?

It’s not uncommon for crypto investors to speculate with new or ‘hot’ cryptocurrencies. Many of these are not successful and can have little or no value. In a situation where the client has current year gains, harvesting these losses can be a successful strategy for reducing taxes.

Step #2: Are there taxable transactions?

If your client has answered yes to any of these questions, the next challenge is determining if there is a current year tax impact. Most clients are aware when they’ve sold crypto currencies for fiat (what crypto people call traditional money like dollars, pesos or euros). However, they might not realize a myriad of other transactions are also taxable. Traditionally, you’d ask the client to download all their transactions for you to analyze in spreadsheets.

With Ledgible Tax Pro, you can quickly invite your client to connect with their Exchanges and Wallets to automatically collect all this information, organize it by crypto currency and analyze it for taxable transactions.

Any access your client provides is ‘read-only’ and enables the applications API integrations to automatically keep the system up to date. The same is true with wallets where the Public Key is used to harvest transactions from our blockchain nodes.

Once they’ve entered the information, they submit it to you for review.

Step #3: Is the impact material?

As with traditional securities, determining the overall impact requires determining the basis, resulting gain/loss and whether it is short/long term. Since your client has already entered all their information into Ledgible, the system has automatically determined the tax basis for each disposition and whether it is long/short term. The system also nets all the transactions together to provide an estimate of the overall gain/loss. This is typically enough to make this distinction.

If more detail is needed or you need to see the crypto gains/losses combined with gains/losses from traditional investments, you can quickly generate detailed reports to dig deeper or pull into your planning models.

Note, it’s only at this point you are charged for using the system. Everything up to this point is free. Also, when you do generate the reports, you generate final reports or imports into the tax return at no additional cost.

Step #4: How to achieve the client’s goals?

Crypto tax planners have two main tools at their disposal. The first is what method to use for determining cost basis. The Ledgible default is FIFO, but you can also switch the system to use LIFO to see if it provides a more optimal result.

The second is focused on Gain/Loss Harvesting strategies. Since Ledgible has the client’s entire history of transactions by cryptocurrency, you can use the system to look for opportunities to achieve the client’s goals. If they have crypto gains in the current year, you can use the system to look for underperforming holdings to potentially liquidate before year end. The filter and sort capabilities of the transaction table make this easy to look at each cryptocurrency held and find those with the highest tax basis which could translate to losses. On the other hand, if they have losses from traditional investments, now may be the time to take some of the crypto gains

All tax professionals recognize the value of tax planning conversations with current and prospective clients. Incorporating crypto tax planning into this process is a great and easy way to further demonstrate the value you provide. With just a single question, you are letting clients with crypto know you are there to support them, and clients without crypto that you’re a resource when they are ready to get started.