Cryptocurrencies, or virtual currencies as the IRS calls them, can be confusing and they’re taking off like crazy. In fact, 55% of people that now trade crypto got into the space in 2021 alone. The technology behind the currencies themselves is complex, as is the network of systems that have sprung up to accommodate the market demand. As popularity for virtual currencies increases both as an asset class and as a way to pay for goods and services, so does the relevance of crypto transactions on our clients’ tax lives.

In IRS Notice 2014-21, 2014-16 I.R.B. 938, the agency outlines it’s basic guidance for virtual currencies. For Federal income tax purposes, virtual currency is treated as property. From there, current tax law applies – but what does this really mean for you, the tax preparer?

As crypto transactions are more scrutinized by the IRS, court cases decided, and precedent set, how to handle crypto transactions difinitively will become clearer. Until then, instead of focusing on the technological aspects of crypto and it’s related markets, let’s focus on disposal events as well as how the income is earned, and apply our current knowledge base.

US tax law requires US citizens to pay tax on income from any source derived and much of the tax code addresses the taxability of various income types – or how income is earned. For example, wages incur social security taxes but interest payments do not. Taxes paid on capital gains are usually lower than on ordinary income. In some cases the tax treatment of income depends on the legal structure of the business as well as how many hours a taxpayer actively participates in an activity.

It follows that the questions around crypto taxes are not necessarily “How is crypto taxed?” and “How much tax will I pay on my crypto.” But more so, “How was the crypto income derived?” , “How does tax law apply”, then “What was the USD value at the time of the crypto transaction?”

We can also not forget that the US tax code allows for the deduction of reasonable and necessary expenses incurred in the course of doing business and this principle would apply to income related to virtual currencies as well.

Below is a breakdown of some basic calculations for cryptocurrency transactions. These examples are designed to be concise, simple, and easy to follow. In reality, crypto traders have dozens, to hundreds, to thousands, of these calculations for any tax year, often in fractional units in the thousandths. After we talk through some of the potential crypto tax scenarios, we’ll also discuss solutions that you have to handle this potentially overwhelming compliance issue.

In order to achieve successful crypto compliance you’ll need to remember the following terminologies and figures:

Basic Requirements for each transaction:

- Full acquisition information including date, quantity, and FMV conversion to USD

- Full disposition information including date, quantity, and FMV conversion to USD

Added complications:

- Small fractions of coins used in trades and purchases

- Multitude of transactions

- Multiple sources for transactions, often uncoordinated

- Statements provided on a per exchange/wallet basis

- Does not identify transfers between exchanges/wallets

- Basis tracking between platforms, exchanges, and wallets

Tax Documentation & Analysis Requirements:

- Transaction file/spreadsheet for each wallet and exchange

- Engage in a conversation with the taxpayer about how they use crypto

- Buy or sell like stock

- Received as payment

- Used as payment

- General philosophy and outlook

- Consider a digital solution to import, analyse, match, and track the entire crypto portfolio when

- Taxpayer has more than 2 wallets/exchanges

- Taxpayer transfers assets between wallets and exchanges

- Taxpayer has many types of income and dispositions from crypto transactions

Now that we’ve walked through some of the basic concepts that tax professionals need to keep in mind, let’s walk through how to translate IRS guidance into actionable crypto tax practices.

Applying IRS Guidance on Virtual Currency Transactions

As we seek to understand how to translate cryptocurrency transactions into standard tax code and ensure compliance for our clients, it’s necessary to understand a few of the various ways cryptocurrencies can be taxed.

Here are some real world sample scenarios.

Note: Due to the complexities of cryptocurrencies and the rapid pace at which the industry moves, the following examples are meant purely for educational purposes.

Capital Gains

When you buy, sell, or transact using crypto currencies, you have an asset disposal which must be converted into USD regardless if USD is ever involved. Because of this guidance, a large amount of cryptocurrency transactions will fall under capital gains treatment. This would include, selling crypto for cash, using one cryptocurrency to buy another (or swapping one for another), and using cryptocurrency to purchase goods and services.

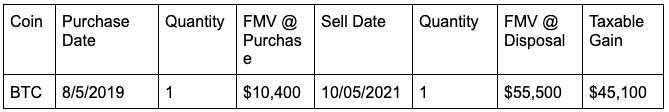

Example: Crypto for cash

Taxpayer purchased one Bitcoin on August 5, 2019 for $10,400 USD. Taxpayer sold one Bitcoin for $55,500 on October 5, 2021. Taxpayer has long-term capital gains (LTCG) of $45,100.

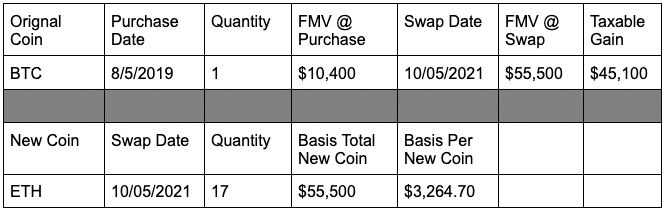

Example: Crypto for crypto

Taxpayer purchased one Bitcoin on August 5, 2019 for $10,400 USD. Taxpayer swapped one Bitcoin with a FMV of $55,500 on October 5, 2021 for 17 ETH. Taxpayer has a LTCG of $45,100, and a basis in the acquired coins of $55,500.

Example: Crypto paid for goods and services

Taxpayer purchased one Bitcoin on August 5, 2019 for $10,400 USD. On October 5. 2021 the FMV of the one Bitcoin was $55,500. On October 5, 2021, Taxpayer used .25 Bitcoin to purchase furniture for their personal residence. The taxable LTCG for this transaction is $11,275 (FMV at disposition minus cost basis).

Ordinary and Other Income

The above examples are just a few ways the complexities of cryptocurrencies are translated into existing tax law. However, disposals are not the only way crypto is taxed. If you receive cryptocurrencies as payment then you have reportable income. How to report this income will depend on how it is earned.

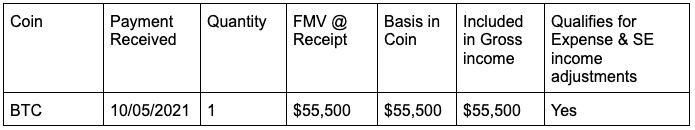

Example: Crypto received as payment for services rendered as an independent contractor:

If an independent contractor receives payment in bitcoin, he would report the FMV of that bitcoin in his gross income calculation, and then be allowed to deduct any reasonable and necessary business expenses. The taxpayers net income would be subject to social security and medicare taxes, but they could also take advantage of potential income adjustments for self-employed health insurance or IRA contributions.

Example: Mining Income

Taxpayers earn mining income when they use their computers and equipment to help validate transactions, which contributes to the blockchain, and helps keep the network secure. How this income is taxed will depend on how many hours a taxpayer spent on the mining activity, if they had a genuine profit motive, and in many cases the legal formation of the business.

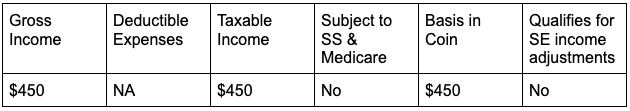

Example: Mining as Other income

Taxpayer set up a computer at home to mine Bitcoin. They did nothing else to facilitate or promote this mining activity. For 2021, taxpayer earned mining income of $450. Based on IRS guidelines for not-for-profit activities, $450 is included in taxayer’s income as other ordinary, reported on line 8i of the 1040 Schedule 1. Taxpayer’s basis in the Bitcoin is $450. None of the expenses related to this activity are deductible.

Example: Mining as a For-profit business

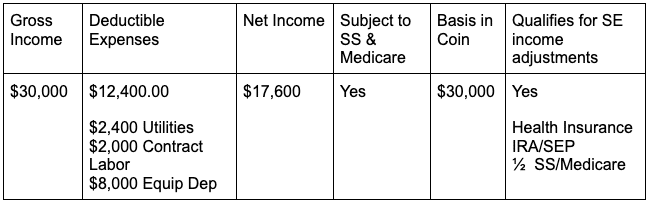

Taxpayer set up a series of computing devices, including maintenance of electrical circuits, in a dedicated space, to mine Bitcoin. For 2021, taxpayer spent $40,000 on depreciable equipment, $2,400 in electricity, and $2,000 in contract labor. In 2021 taxpayer received Bitcoin with a FMV of $30,000. Taxpayer is allowed to deduct $12,400 in expenses, leaving a net profit of $17,600 for 2021. Taxpayer is also allowed to take income adjustments for self employed health insurance as well as IRA deductions, and ½ of social security and medicare taxes. The basis in the coin remains $30,000.

Example: Earn Rewards

Taxpayers can receive and earn rewards on certain exchanges for opening an account, referring individuals to the exchange, or by completing certain tasks like trainings on crypto and reaching account milestones. These rewards are earned regardless of a taxpayer's current holdings; typically this activity is not one entered into for the explicit intent to conduct business. This income is not subject to social security taxes.

Taxpayer receives $5 in Bitcoin for opening an account on an exchange, and an additional $50 in Bitcoin for referring friends to the exchange. Taxpayer has $55 in Other Income, not subject to social security taxes, for 2021. Taxpayer has a basis in Bitcoin of $55.

Translating Crypto Tax Compliance into Reality

As you have likely gained a greater understanding of in this article, ensuring cryptocurrency tax compliance is no easy task, especially as regulations change and new crypto technologies are introduced to the market at rapid paces, like NFTs, and Decentralized Finance. With crypto taxes, you’re really only left with 2 options. Muddle through endless spreadsheets to manually compile all of the non-standard data, or turn to a more automated solution.

As you seek to get a handle on cryptocurrencies and their impact on the tax filing process, one of the most helpful tools you can keep at the ready is a powerful cryptocurrency tax software. With Ledgible’s built in tools and automated workflows, you don’t have to hassle with pages of spreadsheets and non-standard data. The Ledgible platform makes cryptocurrency, legible, to the traditional tax and accounting process. With native integrations to GoSystem and UltraTax, there’s no easier way to file cryptocurrency taxes for your clients.

You can learn more about what Ledgible offers CPAs and tax professionals on their website here, or contact your Thomson Reuters sales representative if you’re interested in purchasing the product.