Decentralized finance, often called "DeFi", is a catch-all term for the movement to create financial protocols and applications on Ethereum that are non-custodial, open-source, and trustless. This means that instead of having to trust a centralized entity like a bank or government institution to keep your money safe, you can instead rely on the security of the Ethereum blockchain. In addition, because these applications are built on Ethereum, they can interact with each other in novel ways - something that is not possible with traditional finance applications. Decentralized Finance also brings some complexities to tax and accounting protocols, which we'll cover shortly and cover crypto tax software for DeFi as well.

How large is the DeFi industry?

The DeFi space is still in its early stages, but it has already seen tremendous growth. In 2019, the total value locked in DeFi protocols grew from about $675 million to over $1 billion. And in 2020, that number is on track to grow even further.

What are the most popular protocols?

There are a variety of different protocols and applications in the DeFi space, each with its own unique purpose. Some of the most popular protocols include MakerDAO (a lending platform), Compound (a lending and borrowing platform), Augur (a decentralized prediction market), and 0x (a protocol for decentralized exchange).

What challenges does DeFi face?

As with any new technology, there are always risks and challenges associated with early adoption. In the case of DeFi, some of the main challenges include scalability issues, regulatory uncertainty, and security concerns. However, as the space matures, it is likely that these challenges will be addressed.

What is the future?

The future of DeFi is very exciting. With the rapid growth of the space, we are already seeing a number of new applications and protocols being developed. In addition, as more people become aware of DeFi and its potential, it is likely that we will see even more adoption and growth in the space.

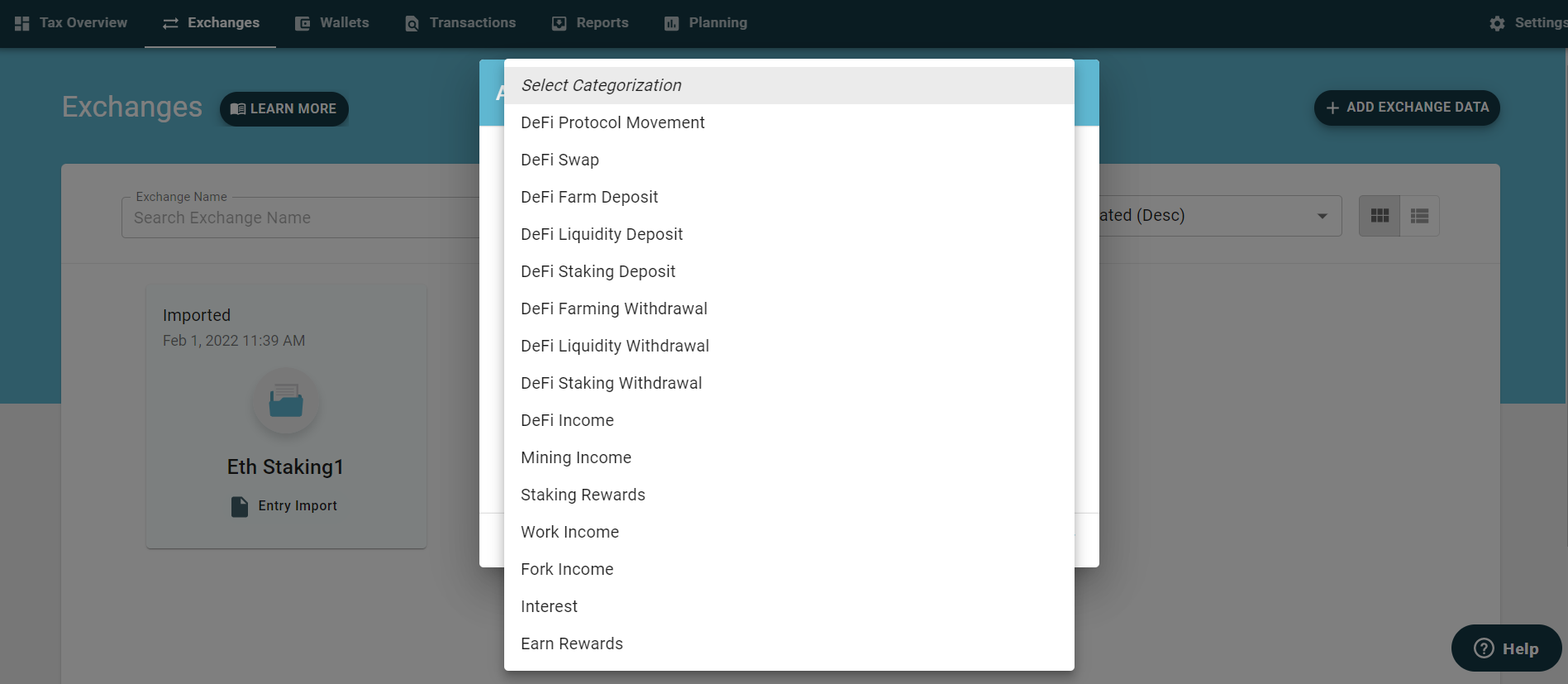

DeFi activity is more than just staking your crypto. DeFi allows users to take part in traditional finance activities like lending, liquidity deposits, mining, swapping, work income, interest or rewards. DeFi covers a broad range of activity and currently, Ledgible requires that this activity be captured through the flexible manual exchange capability. Moving forward, you're going to need crypto tax software for defi – let's take a look at how to use Ledgible for this purpose.

How to sync your DeFi Activity with Ledgible:

You can start by going to the exchange tab:

Next click Add Exchange Data and select Manual Entry and click Next:

Select deposit or withdrawal and Categorize as one of the DeFi Activity options below:

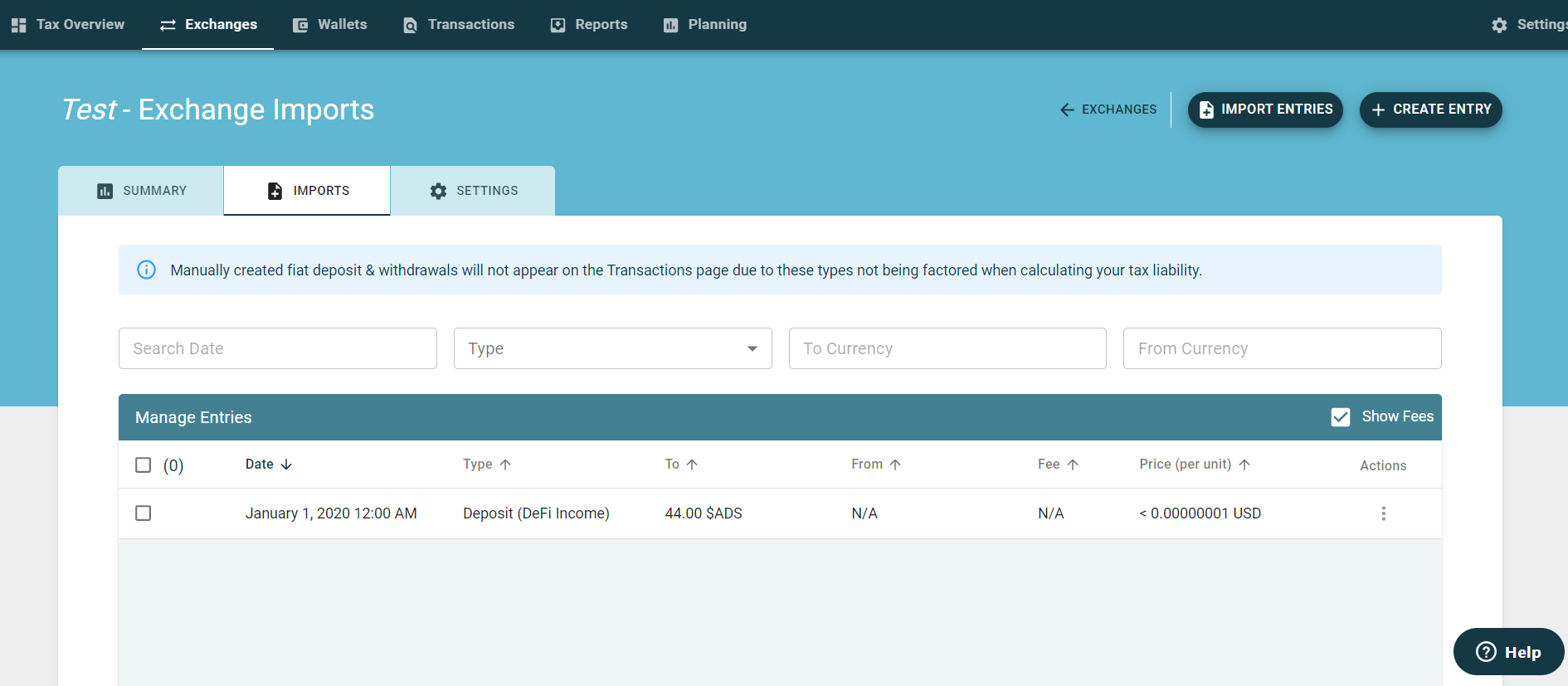

To review or add additional entries, select the exchange you just named and click the imports tab.