To import your cryptocurrency tax information into TaxAct, just follow this guide and have your crypto taxes completed in as little as 20 minutes with Ledgible.

1. Navigating to the correct screen in TaxAct

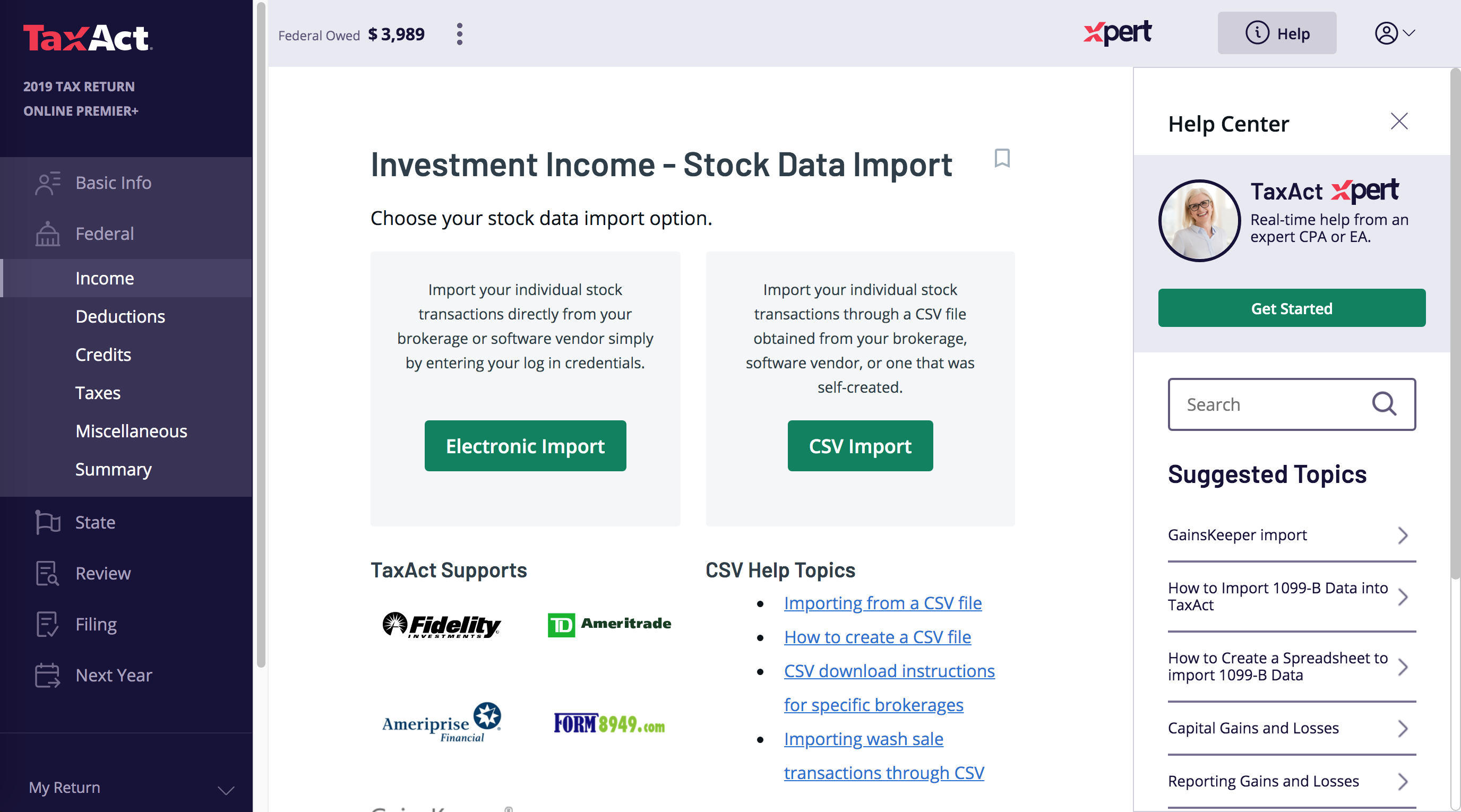

After logging into TaxAct, navigate using the left hand menu to the Investment Income - Stock Data Import page by selecting Federal -> Income -> Investment Income -> Gain or Loss on the Sale of Investments -> Stock Data Import

Your screen should look like this:

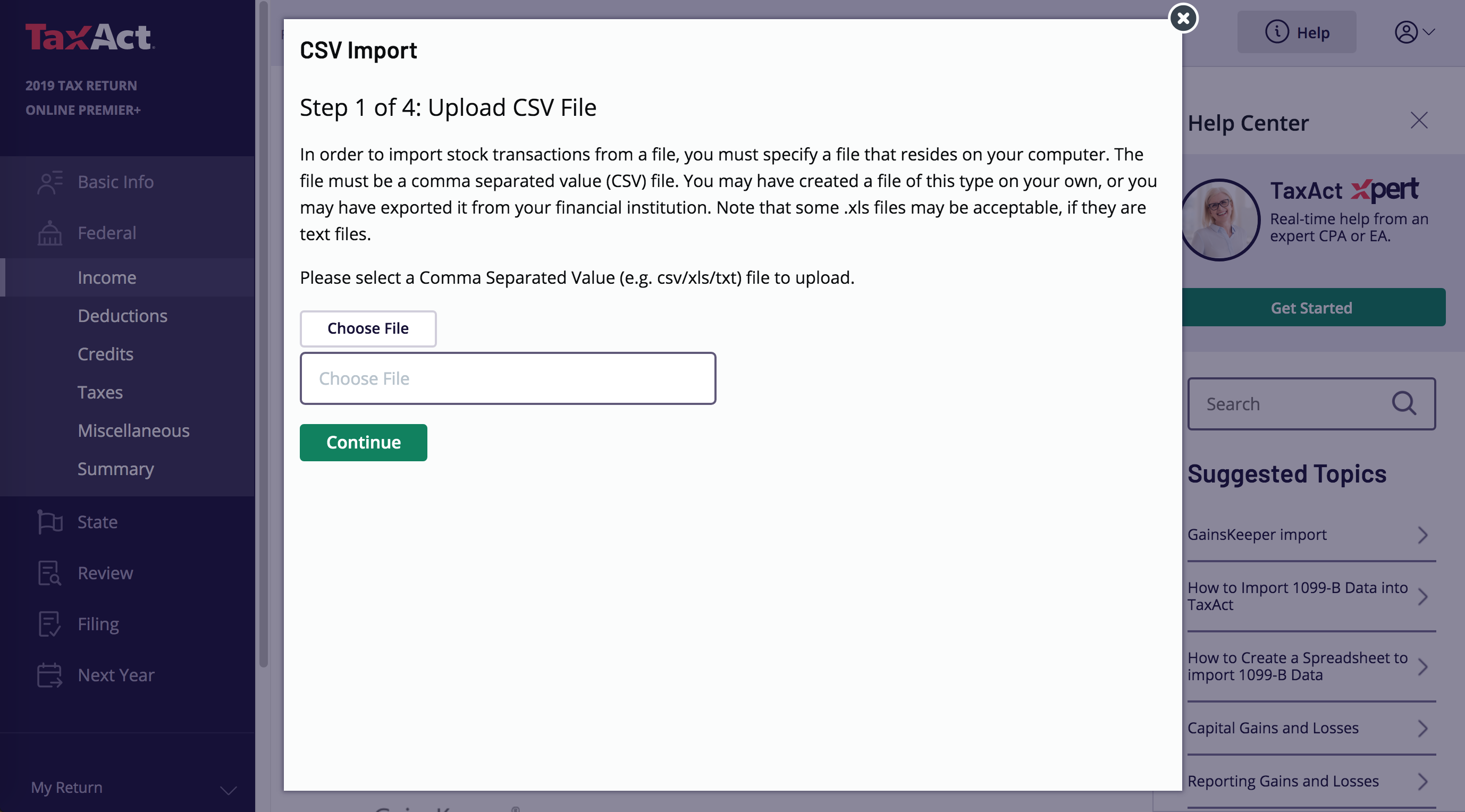

2. Click the Green CSV Import button:

Then Browse and select the Ledgible Tax report you downloaded and click the green continue button.

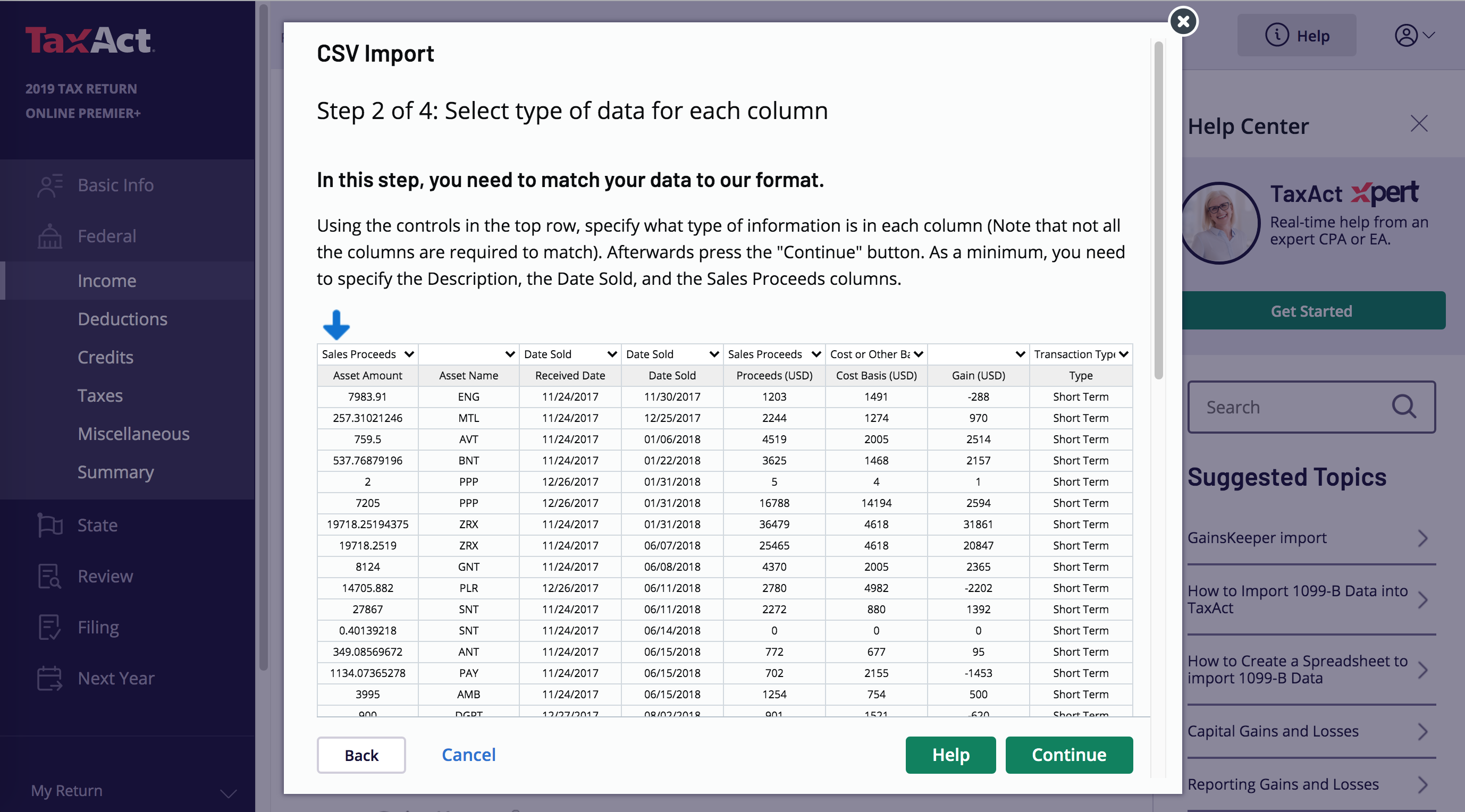

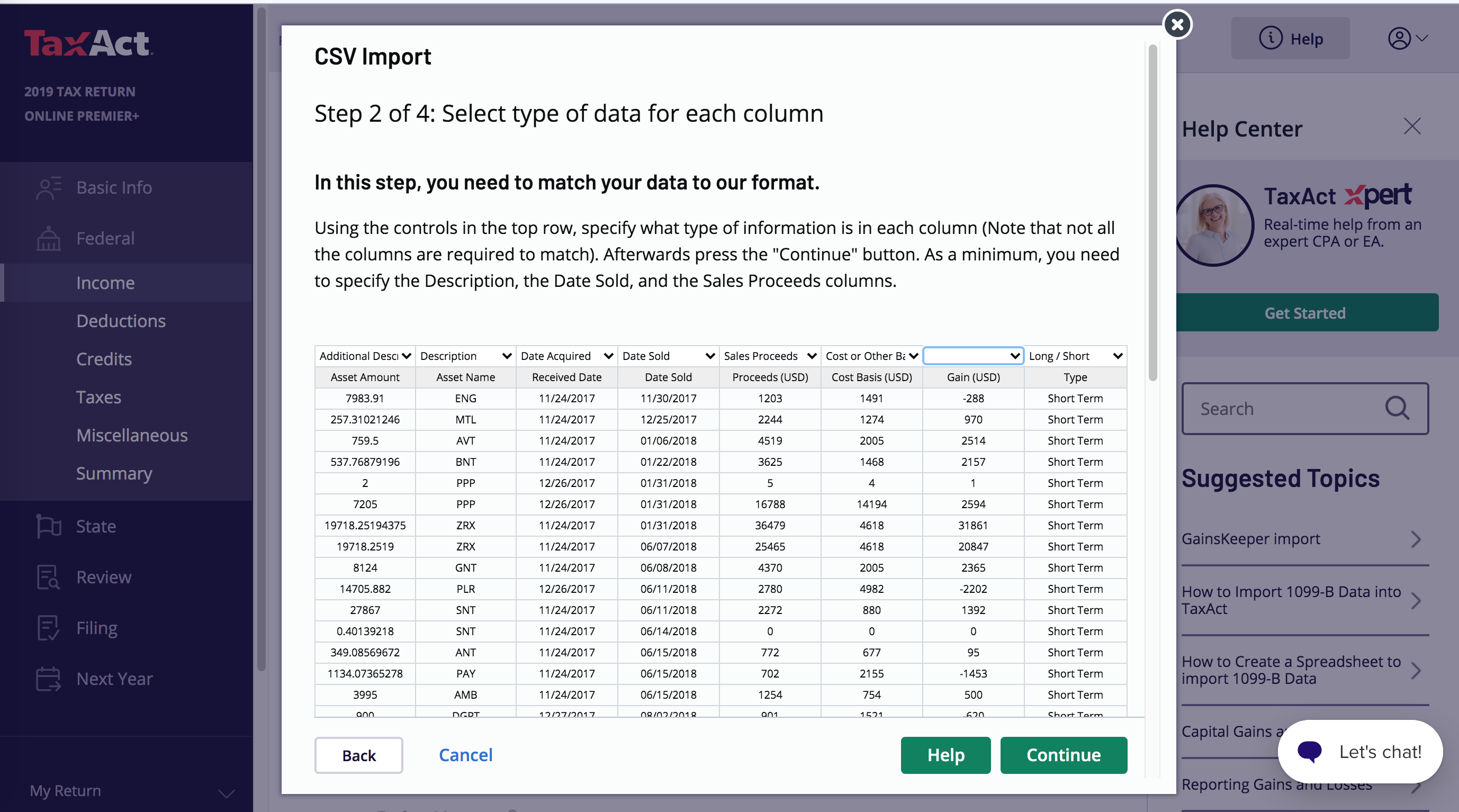

TaxAct will bring up a CSV import screen that shows the data with the TaxAct column names and the current Ledgible Tax column names - A few clicks and it will match perfectly!

Simply click on the following columns and change the choice to the following:

Column1 -> Additional Description

Column2 -> Description

Column3 -> Date Acquired

Column8 -> Long/ShortSelect all rows except the Header row and import

That's it! Now click the green continue button.

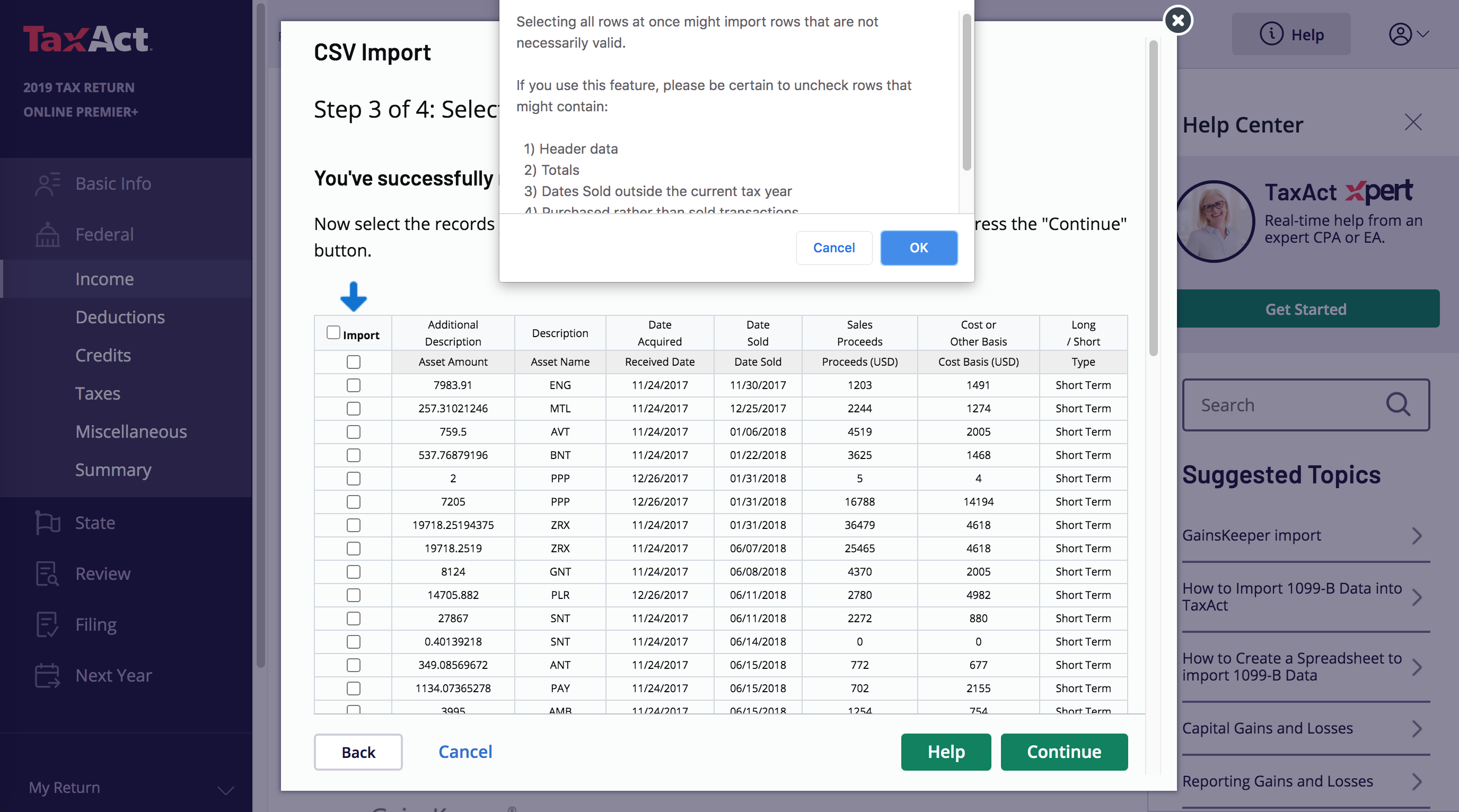

3. Import Crypto Transactions into TaxAct

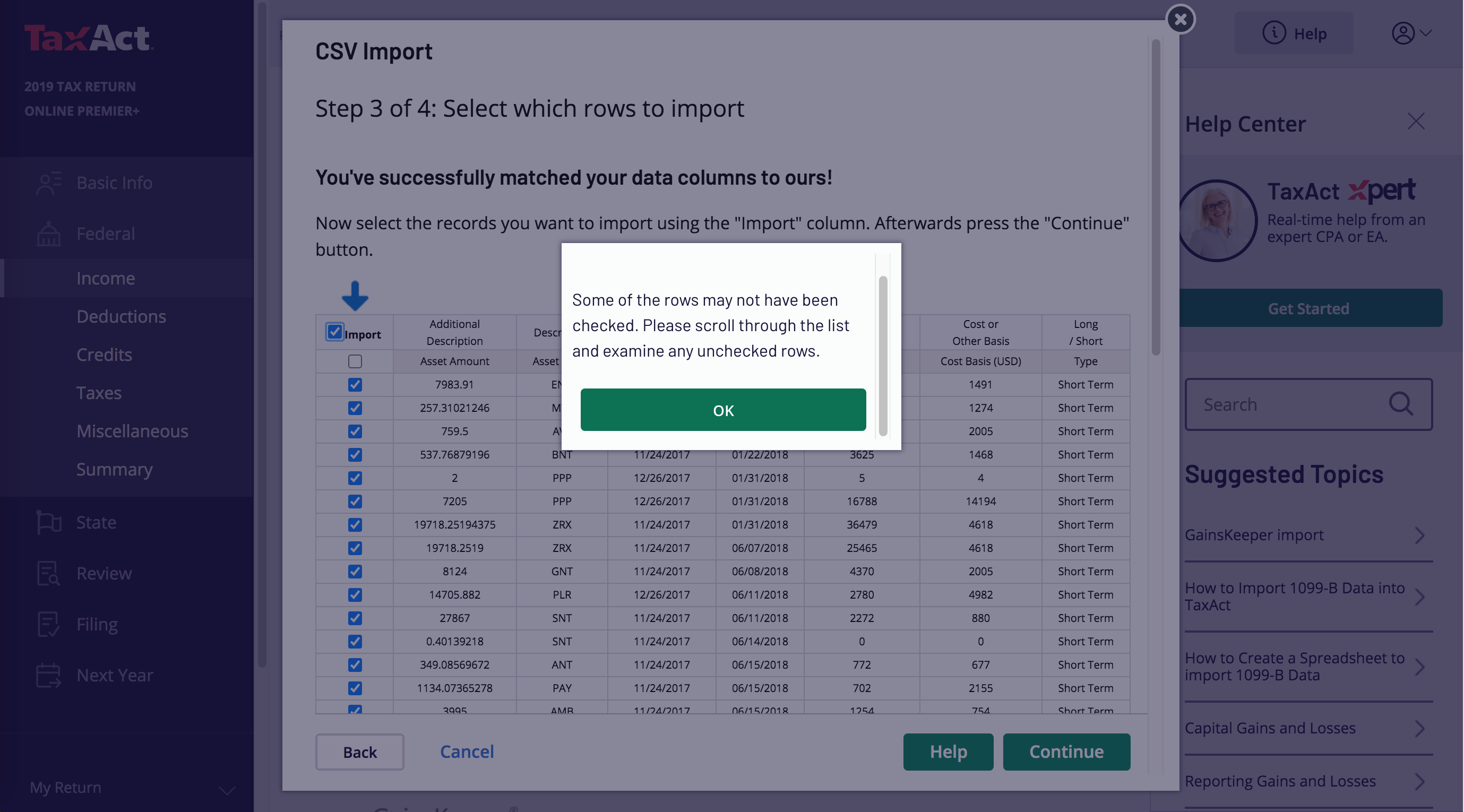

Next click the checkbox to the left of the word Import and it will select all the rows except the header row, which is exactly what we want.

Next click the blue OK button

and next click the green OK button.

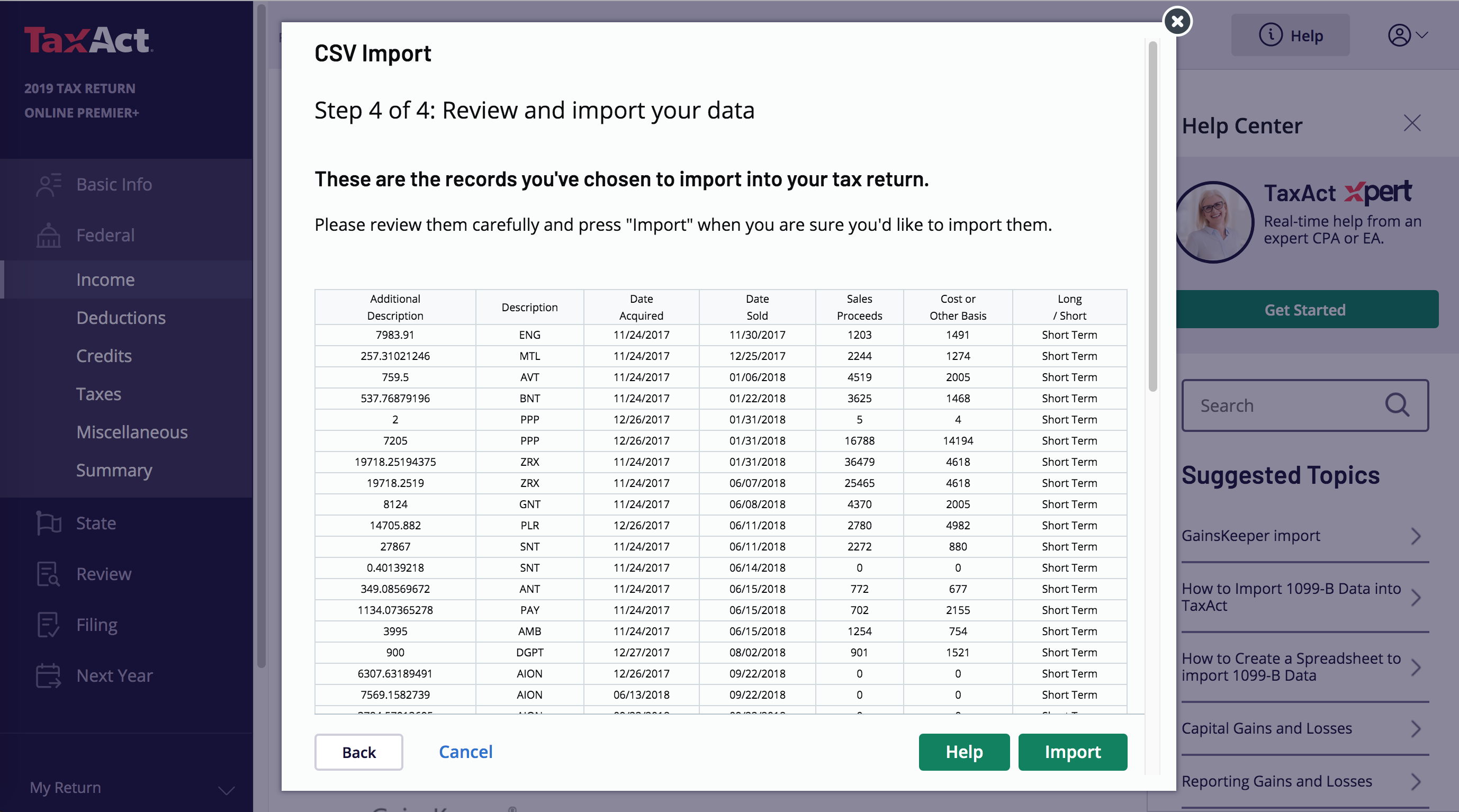

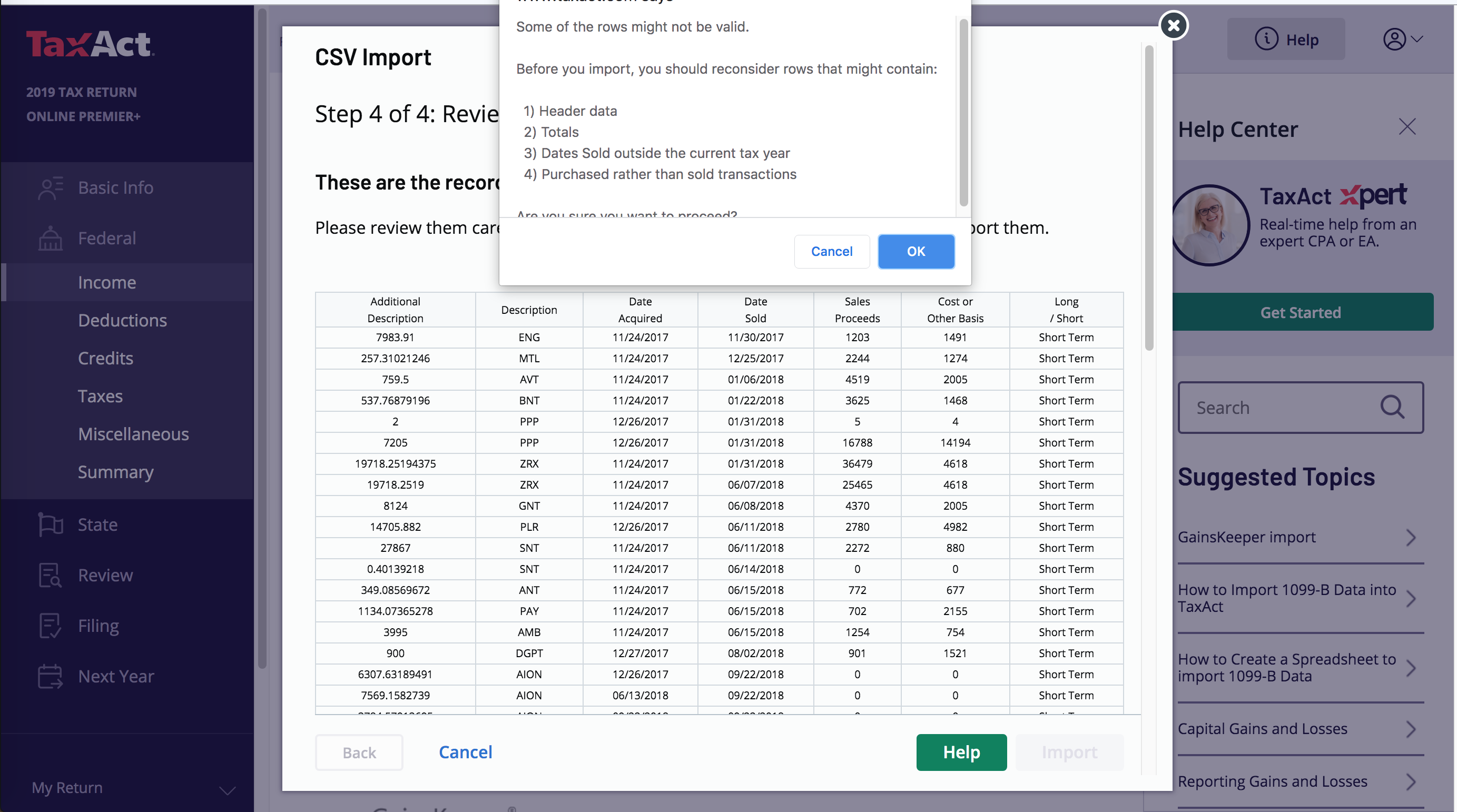

Now the green Continue button and next the green Import button.

and finally the blue Ok button.

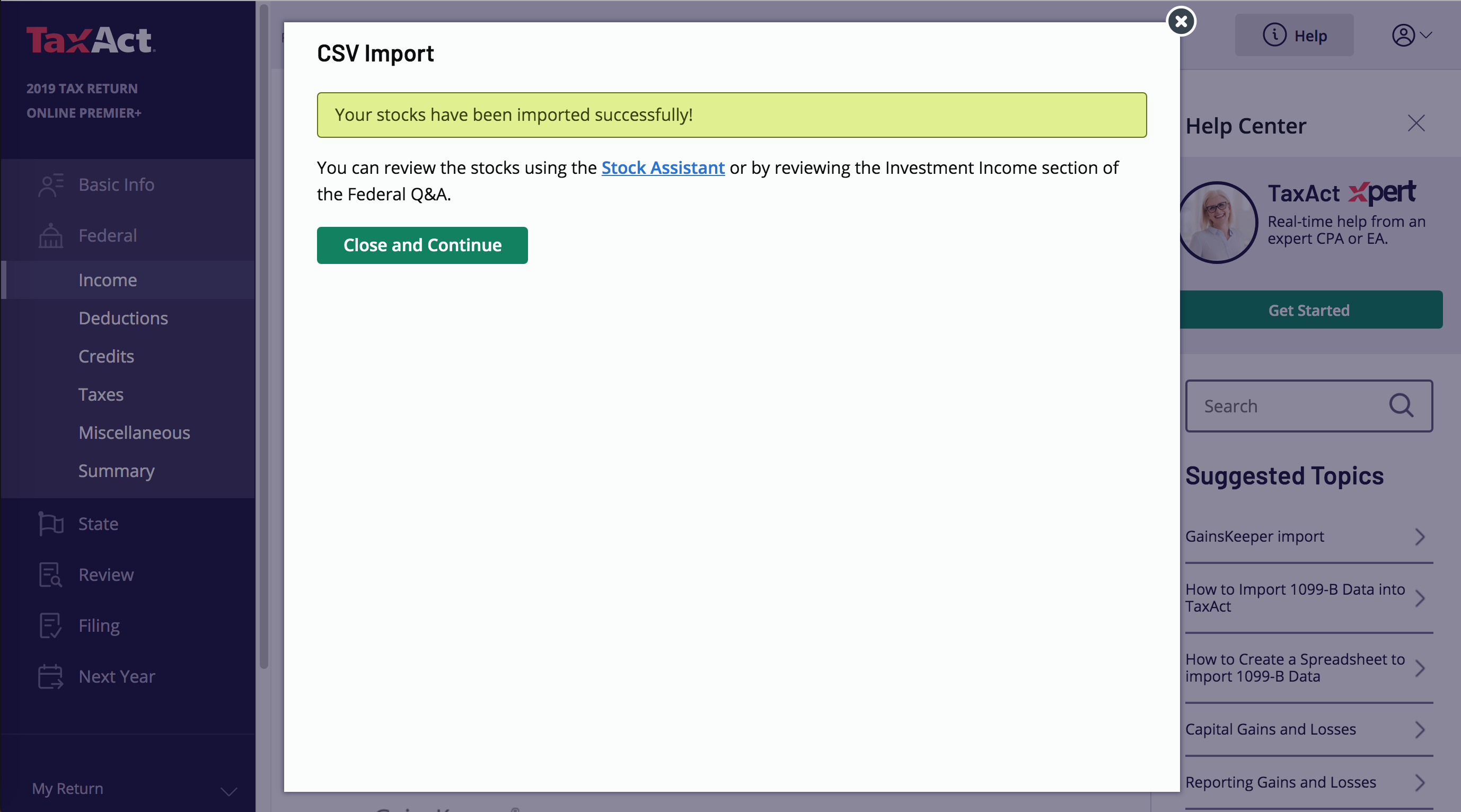

4. Your crypto taxes are done!

That's it - you're done and can close and continue, having imported your Ledgible Cryptocurrency Tax records into TaxAct!

Explore more of Ledgible help and support articles on our knowledge base, here.