The crypto and digital assets industry has received the long awaited proposed regulations seeking regulatory clarity and improving taxpayer compliance. Yet regulatory clarity hasn’t quite been reached in some areas, especially for decentralized players and the emerging real-world asset tokenization industry. But there is still work to be done as the US Treasury Department and IRS seek industry feedback on uncertain areas, weighing the benefits of reducing the tax gap with the increased compliance burden on a growing industry.

By: Jessalyn Dean, VP of Tax Information Reporting at Ledgible

Gabriel Brin, VP of Tax and Accounting Product at Ledgible

Key Highlights

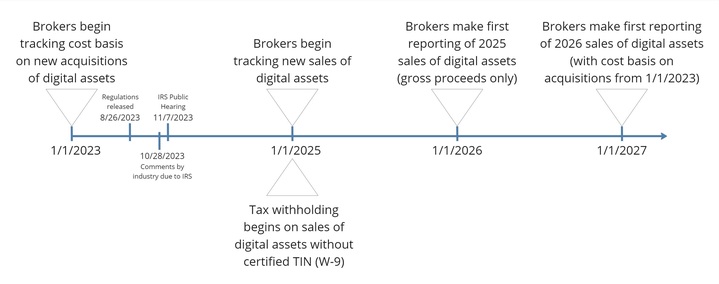

- Timeline: The IRS has adopted a phased-in approach to different components, with gross proceeds reporting coming first, cost basis reporting coming second, and cost basis transfers reporting coming third. In the second phase with basis reporting, only custodial brokers that held the asset from original acquisition through to its sale will be required to report cost basis. This significantly limits the amount of cost basis reporting in the first years of implementation.

- Broker Definition: In most cases, the IRS has reduced the scope of the definition from the original proposal in the US Infrastructure Act. In broadening the definition, they have expanded what it means to “effect a sale” which goes outside of the traditional view of brokers in the financial services industry. As such, miners, validators, staking pool operators, and those not operating a trade or business will typically be out of scope while decentralized exchanges and DAOs could be in scope if they have control or influence over the protocol to make changes to it. As expected, centralized exchanges remain in scope as a broker.

- Digital Asset Definition: In scope are crypto currencies, NFTs, stablecoins, tokenized real estate, tokenized securities, and commodities overseen by the CFTC (even if not approved by them). Out of scope are closed loop tokens used in video games, tokenized inventories, and CBDCs.

- Wash Sales: Though the IRS gave no commentary on this topic in the Background of the proposed regulations, the proposed edits to the regulations show that digital assets will be out of scope (for now) of wash sale loss adjustments reporting. The lack of commentary leaves open the possibility of future intentions to add wash sale rules for digital assets.

- Transfers and Organizational Actions: 6045A guidance for reporting of digital asset transfers and 6045B guidance for reporting of organizational actions are delayed, but no deferral date was provided.

Additional Key Highlights for Tokenization

- Tokenized Securities: Recognizing that tokenized securities could be reportable on both a Form 1099-B as a traditional security and Form 1099-DA as a digital asset, the IRS proposed that these sales would only be reportable on a Form 1099-DA and removes duplicate reporting. This could have deep effects on the decades-old existing reporting infrastructure of regulated mutual funds that are being tokenized onto the blockchain to modernize transfer agent record keeping.

- Tokenized Real Estate: Similar to tokenized securities, the IRS proposes these are sales of digital assets and reportable on a Form 1099-DA. However a coordinating rule was added so that sales of tokenized real estate that are reportable on a Form 1099-S should remain as such and not double reported on a Form 1099-DA. The IRS was silent in addressing the more typical use case of Schedule K-1 reporting that results from LLC and partnership structures thereby leaving open the possibility of duplicate reporting on Form 1099-DA for such cases.

- Tokenized Commodities: Digital assets sales that are both commodities reportable on a Form 1099-B and a digital asset reportable on Form 1099-DA will only be reportable on a Form 1099-DA to remove duplicate reporting.

“The 282 pages of new regulations released on 8/25/23, about 6 months after OIRA review was complete, show that Treasury and IRS have given a lot of thought to these new regulations. The IRS and Treasury also hint at expecting several comments on these regulations. They have scheduled a public hearing for November 7th, and also state that a second public hearing could be held on November 8th. In addition to the possible two days’ worth of public hearings, they explicitly ask for feedback on 51 specific questions. Particularly interesting is that, despite the regs being 282 pages long, there are still areas where more guidance is needed. For example, how will decentralized exchanges comply with the new regs if they are unable to obtain taxpayer identification numbers?” said Nik Fahrer, Senior Manager at FORVIS in response to the proposed regulations. Fahrer is a member of the Virtual Currency Task Force of the AICPA and participates in the Wall Street Blockchain Alliance. FORVIS ranks among the top 10 public accounting firms in the United States.

Background

Digital asset tax reporting was first proposed in H.R. 3684 - Infrastructure Investment and Jobs Act in 2021. Prior to this, the financial services industry had a multi-decades long compliance framework for the tax reporting of payments of income and sales of certain financial assets. While some disagreement existed as to whether this existing framework covered crypto and other digital assets, there was a general consensus in the industry that this framework did not provide for enough clarity to ensure consistent application amongst all players that could be in scope of its requirements. Additionally, innovation in the digital assets industry created new providers that were uncertain if they were even in scope at all of this existing framework. Now we have received the proposed regulations on implementing the tax reporting of the sales of digital assets, including the reporting of proceeds of those sales and the cost basis of the sold asset amongst other details. The primary objective of these proposed tax reporting regulations is to close the so-called “tax gap”, which is the difference between tax revenue expected (by the US government) and tax revenue received (through taxpayer compliance). The secondary objective of these proposed tax reporting regulations is to relieve the compliance burden currently resting on the shoulders of the individual taxpayer themselves, who frequently have to pay for the help of tax advisors or crypto tax compliance software in order to properly calculate their taxes.

Next we will take a deep dive into some key specifics of the proposed regulations.

Key Dates

Note this timeline is not inclusive of every possible date. It is instead just the highlights.

The Fine Print on Crypto and NFTs

Definition of Broker

In the original US Infrastructure Act, a broker was very widely defined as “any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.” Under the proposed regulations, it now reads as “any person … U.S. or foreign, that, in the ordinary course of a trade or business during the calendar year, stands ready to effect sales to be made by others.”

The IRS has reduced the scope of this definition by reducing “transfers” to “sales” and reducing “for consideration” to “in the ordinary course of a trade or business”. The IRS has increased the scope by more precisely defining the word “effect sales” which includes providing a party in the sale with access to an automatically executing contract or protocol, providing access to digital asset trading platforms, providing an automated market maker system, providing order matching services, providing market making functions, providing services to discover the most competitive buy and sell prices, or providing escrow or escrow-like services to ensure both parties to an exchange act in accordance with their obligations.

These scope adjustments have the resulting effect of bringing certain stablecoin issuers, initial coin offering (or ICO) issuers, decentralized services, decentralized exchanges, and DAOs into the definition of broker where persons have the ability to control or modify the smart contracts. These scope adjustments eliminate most miners, network validators, many staking pool operators, wallet key custodians, and people that participate in blockchain activity as a hobby or community interest.

A few other notes of interest:

- Though certain decentralized providers could be in scope of the definition of broker, their reporting obligations would exclude the reporting of cost basis information in the case that they are non-custodial services.

- While certain providers are now outside of the scope of Form 1099-DA broker reporting for sales of digital assets, they would still need to assess if they could have other Form 1099 reporting obligations under other Internal Revenue Code sections (such as IRC 6041 for Form 1099-MISC and NEC reporting).

- Brokers can be US or non-US though the requirements that apply to each of them are different. Digital asset providers that might consider shipping their services offshore of the US would still be in scope of broker reporting if they offer their services to US Persons. This is not any different than existing broker reporting for traditional securities though the IRS has updated certain definitions to reflect an industry that typically has no fixed offices from which they execute their services. This also reflects the approach taken by the European Union in drafting the DAC8 which aims to create a tax reporting infrastructure for crypto and digital assets within EU Member States.

“The Treasury and IRS go on to estimate that these new broker reporting rules will impact approximately 600 to 9,500 brokers and cite CoinMarketCap.com as a source. There is still a lot of ambiguity in who the broker reporting rules will be applicable to, especially for decentralized exchanges. As currently written, it seems that almost all decentralized exchanges will have to comply with these new broker reporting requirements if they have U.S. customers. On the plus side, the new regs do make it clear that these new broker reporting requirements are not applicable to miners, stakers and validators.” said Nik Fahrer, Senior Manager at FORVIS in response to the proposed regulations.

Payee Documentation

The requirements on how to document payees (similar to KYC and AML procedures) are not significantly different than the existing rules for traditional financial institutions but it is worth mentioning for the digital asset native industry:

- A reverse lookup of a customer’s tax identification number (TIN) from identity verification databases or only storing the last 4 digits of their TIN is insufficient for the purpose of US Form 1099 reporting. Brokers will be required to collect a so-called “certified TIN” which means obtaining a signed IRS Form W-9 with a complete 9 digit TIN (or adequate substitute online form as allowed by the IRS).

- The proposed regulations provide clarity on what non-US (foreign) brokers need to do in order to prove they are not doing business with US Persons and in case they are, what withholding and reporting obligations would apply to them.

Tax withholding

These requirements are largely not discussed in the commentary of the proposed regulations as the IRS sees the existing framework as sufficient to address digital assets. What is notably absent is how a non-custodial provider, like a decentralized exchange, would be able to perform tax withholding (also called backup withholding) in the absence of possession or control of any customer assets. More guidance will be needed from the IRS on how a decentralized exchange could comply with tax withholding obligations such as where a certified TIN has not been obtained from the customer, and what penalty relief may be available to them in the case that they cannot.

Sales of Digital Assets

- Hard forks and airdrops are not considered a sale of a digital asset.

- A disposition of a digital asset to pay digital asset transaction fees is considered a sale of a digital asset in exchange for services.

- IRS provides guidance on reasonable valuation methods for hard to value assets and the consequences of being unable to obtain such reasonable valuation.

- IRS did not provide proposed guidance on whether transfers of digital assets in and out of liquidity pools or wrapping and unwrapping of assets are considered sales of digital assets and instead have requested comments from the industry on a path forward.

Cost Basis

While the calculation of basis remains largely the same conceptually as other assets, the proposed regulations address a few key points including how to adjust basis for digital asset transaction costs (e.g. gas fees), wash sale adjustments, ordering rules for disposing of assets, and when cost basis reporting is not required by a broker.

- Initial cost basis of a digital asset includes the amount paid by the customer increased by any commissions, transfer taxes, or digital asset transaction costs related to its acquisition. For most sales, these adjustments will reduce the proceeds on the sale.

- An exception is made where one digital asset is exchanged for a materially different digital asset. In this case, half of the digital asset transaction costs are allocated to the sale side and half of the digital asset transaction costs are allocated to the acquisition side. As this is not common practice today, the taxpayers and software developers will have to make adjustments to account for this new adjustment to basis tracking.

- The ordering rules for disposals of tax lots indicates that specific identification of tax lots by the taxpayer should be made no later than the date and time of the sale with the broker. In the absence of a specific identification of tax lots by the taxpayer, the broker must dispose of the earliest units first of either acquired within or transferred-in assets. For this purpose, and until 6045A transfer reporting is implemented, the date used for determining the earliest lots of transferred-in assets is the date and time of the transfer-in, and not the actual acquisition date and time (even if the broker has it).

- Digital assets will be out of scope of wash sale loss adjustments reporting. This is consistent with common practice today.

- A safe harbor for brokers where de minimis errors are made in cost basis reporting will be added later.

- In the first wave of basis reporting, brokers only report cost basis if the asset was acquired, held until sale, and then sold by that same custodial broker for the benefit of the customer.

- As decentralized exchanges and DAOs do not offer hosted wallets, they will not be in scope of cost basis reporting though they will still be in scope of proceeds reporting (if they meet the criteria to be a broker).

Form 1099 Reporting

Here is the list of information that will be reported on IRS Form 1099-DA, with no de minimis reporting threshold offered by the proposed regulations:

- Customer’s name, address, and TIN;

- Name or type of the digital asset sold and the number of units sold;

- Sale date and time in UTC;

- Gross proceeds of the sale;

- Transaction ID or hash associated with the sale, if any;

- Whether the consideration received was cash, different digital assets, other property, or services;

- Other items not listed that may apply where a digital asset sale is also a sale of securities;

- Sometimes - where cost basis reporting is required:

- Acquisition date and time of the asset in UTC;

- Adjusted cost basis of the asset sold;

- Long term or short term character of the sale;

- Sometimes - where cost basis reporting is not required for transferred-in assets prior to 6045A guidance:

- Date and time of transfer-in transaction;

- Transaction ID or hash of transfer-in transaction;

- Digital asset address(es) from which the transferred-in digital asset was transferred;

- Number of units transferred in by the customer as part of that transfer-in transaction.

Traditional securities reporting has the concept of exempt payees for which a broker is not required to issue a Form 1099. This exempt payees list for securities is the same for digital assets. An exempt payee was not added for payments to other “Digital asset brokers”. This means that where multiple tiers of brokers are involved in a payment flow that unnecessary duplicate reporting can occur.

Third Party Settlement Organizations (“TPSOs”) under Form 1099-K reporting can also be brokers for digital assets. In this regard, a payment processor can be a “digital asset payment processor” under the proposed regulations for Form 1099-DA with respect to the purchaser of a good or service and a TPSO for Form 1099-K with respect to the seller/merchant. In this case, though the TPSO is processing digital payments it will not report payments to the seller/merchant on a Form 1099-DA to avoid duplicate reporting. Further complexity arises in the proposed regulations around NFTs as these arrive in the definition of a digital asset and are also considered a “good or service” under TPSO reporting regulations. NFTs can therefore be reportable on a Form 1099-K when traded using certain brokers.

The Fine Print on Tokenized Securities, Real Estate, and Other Financial Products

- Recognizing that tokenized securities could be reportable on both a Form 1099-B as a traditional security and Form 1099-DA as a digital asset, the IRS proposed that these sales would only be reportable on a Form 1099-DA and removes duplicate reporting on the Form 1099-B. Many token issuers active in this space are SEC regulated mutual funds. As such, the proposed regulations create more questions than answers such as whether these mutual funds would continue to be subject to wash sale reporting rules since sales of digital assets are not in scope of wash sale rules, and whether accounting for proper adjustments to cost basis is allowed such as return of capital. While it is expected that the IRS did not intend for these securities to suddenly fall out of wash sale reporting rules, clarity in the final regulations would be prudent to avoid misinterpretations.

- For tokenized real estate that is held in an LLC or partnership structure, investors will receive both a Form 1099-DA for the sale of the token in addition to a Schedule K-1 from the LLC or partnership for the same transaction. The proposed regulations did not address this use case of tokenized real estate and were therefore silent as to how adjusted cost basis would be calculated in this case, whether it would follow basic digital asset principals or the actual underlying economic reality of the LLC or partnership holding the real estate.

- Sales of non-tokenized real estate (i.e. real estate that is not a digital asset) are still subject to existing Form 1099-S reporting rules for payments made to the seller. Proposed regulations will require Form 1099-DA reporting where the buyer pays with digital assets.

- For commodities, the definitions for purposes of reporting under 6045 will be modified to include new language for self-certified CFTC commodities, adding to the existing definition of approved CFTC commodities. This will bring into scope of Form 1099-DA any digital asset commodities that were otherwise not CFTC approved.

- Where certain financial contracts (e.g. options and forward contracts) are not themselves a digital asset because they are not recorded on a cryptographically secured distributed ledger or any similar technology, then they are covered securities subject to mandatory basis reporting even if they reference a digital asset that is not held by the broker in a hosted wallet.

Reactions from Ledgible Experts

The US Treasury and IRS have demonstrated their extensive knowledge of the crypto, digital assets, and blockchain industry with the publication of the proposed regulations.

Tokenized Real-World Assets

In their most basic form, tokenized assets are simply digital receipts for something else. Yet the IRS is proposing to create tax reporting on the sales of these digital receipts, rather than looking through to the underlying asset for the appropriate tax reporting to apply. This could lead to interpretations of the proposed regulations that cost basis rules of digital assets should apply rather than the more appropriate cost basis rules for the underlying asset of value. Without clarifying commentary from the IRS on this point, inconsistent basis rules for taxpayers could result, depending on if the underlying asset was sold with a token for a receipt or a piece of paper for a receipt.

The impact to the tokenized securities industry would be significant. Many use cases in tokenized securities today are SEC regulated mutual funds which are already required to report their distribution payments on either Forms 1099-DIV or 1099-INT and sales of the funds on Form 1099-B. Most of these tokenized use cases are closed loop in a way, well known traditional financial institutions that are modernizing their transfer agent record keeping without any intention of offering other digital assets like crypto currencies for sale on their platform. As such, they would be well suited to continue reporting these sales of tokenized mutual funds on Forms 1099-B rather than completely reworking them to report on a new Form 1099-DA. Given the highly regulated nature of these mutual funds, one can find little reason for such distrust of the existing reporting infrastructure. Input from the tokenization industry and traditional financial institutions operating in this space should help the IRS to draft more appropriate coordination of rules to address their concerns around reporting holes that may exist in the future when taxpayers are potentially able to withdraw these tokenized securities to their private wallets.

The proposed regulations also attempt to address tokenized real estate but seem to miss the mark in understanding how most tokenized real estate is issued today. The majority of tokenized real estate still requires an entity to hold title to the real estate. This means that the token really represents an interest in what is typically an LLC or partnership structure. The proposed regulations did not contemplate this use case and therefore offer no coordinating rules to eliminate duplicate reporting that would result from a Form 1099-DA being issued on the sale of the tokenized real estate and the Schedule K-1 being issued from the LLC or partnership during the annual IRS Form 1065 filing. In this case, the Schedule K-1 reporting would be far more appropriate to retain and exempt it from Form 1099-DA reporting. This is because the cost basis calculation and reporting on Schedule K-1 is far more complex and comprehensive than that offered by the Form 1099-DA proposed regulations and is therefore more suitable for enhancing taxpayer compliance.

Practical Issues of Decentralized Providers and Tax Withholding

The IRS uses tax withholding as a kind of stick to force taxpayers to provide their complete and accurate TIN to brokers. Where a taxpayer refuses to provide or certify their TIN, then the broker begins tax withholding of 24% on payments such as proceeds on the sale of a reportable asset. This tax withholding, also called backup withholding, can then incentivize the taxpayer to comply with TIN requests from the broker. Additionally, where the broker cannot obtain a valid TIN from their customer then they are viewed as being compliant with the tax withholding and reporting laws by performing the backup withholding. They are not required to close the account of the customer so long as they take and remit the backup withholding. But in the case of decentralized exchanges (“DEXs”), as example, the proposed regulations suggest that so long as they have control or influence over the protocol to make changes to it then they are in scope of Form 1099-DA reporting and are therefore required to obtain a certified TIN from their customers. Though the IRS recognizes that these DEXs do not host the wallets and therefore do not have custody of the digital assets, they do not offer any coordinating guidance that acknowledges that such DEX would therefore not be in any position to withhold tax on any payments from their customers that refuse to comply with certified TIN requests. Without any viable stick, like tax withholding, for the DEX to force the hand of its customers to give them a certified TIN, then many customers of these DEXs will simply ignore the requests for their TIN. The DEX will then have mostly missing TINs in their Form 1099-DA reporting to submit to the IRS and without any guidance on penalty relief. The costs to the DEX (and the digital asset industry) of potentially alienating their customer base from doing business with them far outweigh the benefits of the low quality Forms 1099-DA reporting that will be received by the IRS. This missing guidance must be addressed in the final regulations.

Time Zones and 24/7 Nature of Crypto

It is interesting to observe in the commentary to the proposed regulations that the IRS recognizes the 24/7 nature of crypto and digital assets and therefore has given clear guidance that UTC is the proposed time zone for reporting purposes. This means that if Taxpayer A sells Asset B at 10pm Eastern on December 31 Year 1 which is 3am UTC on January 1 Year 2, then the broker must report the sale on a Year 2 Form 1099-DA. However this will require taxpayers to receive guidance for their own personal tax return filing (e.g. IRS Form 8949) in order to reconcile reporting and paying taxes on the sale in Year 1 in their Form 8949 but receiving a Form 1099-DA in the following Year 2 for that sale.

Also missing is guidance on how brokers need to interpret the timely tax deposit rules when backup withholding is taken from sales proceeds. At what time does a “day” cutoff for purposes of determining when the deposit must be made by?

Cost Basis and Wash Sales

The delay of 6045A transfer reporting means that taxpayers that move their crypto to self-hosted wallets or between different brokers (e.g. different centralized exchanges hosting their digital assets) will lose any basis reporting when they sell it in the future. This means that in the first years of Form 1099-DA reporting, only taxpayers that buy, hold, and sell all of their crypto on a single exchange will receive the full benefits of Form 1099 reporting.

Though the IRS gave no commentary on the topic of wash sales in the Background of the proposed regulations, the proposed edits to the regulations show that digital assets will be out of scope (for now) of wash sale loss adjustments reporting. The lack of commentary leaves open the possibility of future intentions to add wash sale rules for digital assets. We believe that the IRS needs to address this intention head on in the commentary to the final regulations. Brokers need time to prepare and build for their future obligations. They may make different decisions early on when they have a more clear picture of what’s coming ahead.

State 1099 Reporting

We are anticipating how the different States react to the proposed regulations and if they will conform to or deviate from any IRS definitions and requirements. It should be expected that at least some States will request their own filing of Form 1099-DA type reporting that may need to be filed separately from any combined Federal/State filing program.

How Brokers Can Prepare

- Form an internal steering committee and join industry working groups.

- Determine who owns the tax reporting function, KPIs, and budget: Operations, Compliance, Tax, or someone else?

- Recruit and hire the right people (employees vs consultants), considering using an outsourced managed services model or building the knowledge in-house.

- Develop and coordinate training in your organization, with a focus on customer service agents addressing tax questions for geographically diverse customers.

- Analyze and decide build vs buy.

- Consider voluntary reporting in advance of mandatory reporting timelines where customer demands require it or as proof of concept.

- Begin collecting certified TINs or certifications of foreign status from all new customers, and make a plan for documenting existing customers.

- Track and store customer lot level transaction data.

- Build a user interface for customers to select which lots they want to sell.

- Track asset transfer-in data.

- Build tax withholding calculation, conversion, and remittance systems to ensure timely deposits to the IRS.

- Analyze, filter, generate, file, and distribute Forms 1099 to the IRS, payees, and State Revenue agencies.

- Develop an IRS and State Revenue agency governance model to address IRS and State notices.

Make Your Voice Heard

Treasury and the IRS seek industry input into the proposed regulations and the open topics that they have yet to address. We encourage the industry to participate, either by submitting your own comment letters to the IRS or by collaborating with industry working groups to submit joint feedback.

- Beginning on page 137 of the PDF of the commentary and proposed regulations you can find the list of 51 questions on which the IRS seeks specific feedback. Written comments are due by October 28, 2023. Instructions for submitting written comments can be found on page 169.

- A public hearing is scheduled for November 7, 2023 at 10am Eastern Time in Washington DC. Requests to attend and to testify must be submitted to the IRS in writing and instructions for these requests are found beginning on page 169 of the PDF. An overflow day is also scheduled for November 8, 2023 if demand exceeds capacity for November 7, 2023.

Who is Ledgible, How Can We Help

Ledgible has developed a network of partnerships with other software providers in order to assist you in developing your customized fit-for-purpose tax reporting operating model. We customize our cost-basis tracking and reporting solution to fit your unique needs. Integration with our partners ensures your compliance needs are covered in customer onboarding, tax withholding calculations, and annual reporting.

Disclaimer

This blog post does not constitute tax or legal advice nor does it constitute a tax or legal opinion. Independent tax and legal advice must be sought by our readers to assess their own circumstances against these proposed regulations. This blog is Ledgible’s first assessment of the impact of the proposed regulations as of August 2023. This means that our assessment should, and will, change as differing interpretations are debated and ultimately when final regulations are issued by the US Treasury and IRS which will significantly alter the assessment provided.