NFTs are rapidly becoming incredibly popular, both among users of crypto, as well as among people who do not otherwise own crypto. We have written this guide to explain to you the basics of what an NFT is. If you are looking for how to import NFT activity into Ledgible, click here.

NFT stands for Non-Fungible Token. That means that a token is unique and is not, or can not be, replicated. Cryptocurrency tokens, such as bitcoin, are Fungible, meaning there can be multiple bitcoin tokens with identical properties.

What makes an NFT is the token being backed by the blockchain and being able to track all transactions that have occurred with the token and who owns or owned the token at any point in time.

At this current point in time, the most popular use of NFTs is images and gifs as NFTs. However, technically anything that exists digitally can be turned into an NFT, such as videos, documents, web domains, and much more.

NFTs can sell for very high value, so many use them as a vehicle for investment. However, just like any investment (especially crypto) they can be very volatile and their value can decrease just as easily (maybe even easier) as it can go up. Many people also just enjoy collecting NFTs and having the status of being the sole owner of the image, gif, document, or other digital item.

What are NFTs?

Non-fungible tokens are digital assets that are unique and cannot be replaced by another identical asset. NFTs are stored on a blockchain, which is a digital ledger that records transactions. NFTs are often used to represent ownership of digital items such as artwork, music, or in-game items.

Are NFTs taxed?

NFTs are taxable just like any other type of property. The tax implications for creators and investors can vary depending on the circumstances.

For NFT creators, taxes may apply to the sale or exchange of NFTs. For NFT investors, taxes may apply to the purchase, sale, or exchange of NFTs. NFTs may also be subject to capital gains tax.

How are NFTs taxed?

The answer to this question depends on the jurisdiction in which the token is created or traded. Currently, there is no uniform treatment of NFTs for tax purposes globally. Some countries may treat NFTs as property, while others may treat them as commodities or even currency. In the United States, NFTs are generally treated as property for tax purposes. This means that NFTs are subject to capital gains tax when they are sold or exchanged.

For NFT creators, taxes may also apply to the sale or exchange of the tokens. Creators should consult with a tax advisor to determine whether any taxes are due on the sale or exchange of their NFTs.

For NFT investors, taxes may apply to the purchase, sale, or exchange of these tokens. Investors should consult with a tax advisor to determine whether any taxes are due on the purchase, sale, or exchange of NFTs.

NFTs may also be subject to other taxes, such as sales tax or value-added tax. Investors and creators should consult with a tax advisor to determine whether any other taxes apply to their NFTs.

What are the capital gains tax brackets?

The tax rate for NFTs depends on the jurisdiction in which the NFT is created or traded. Currently, there is no uniform treatment of NFTs for tax purposes globally. Some countries may treat NFTs as property, while others may treat them as commodities or even currency. In the United States, NFTs are generally treated as property for tax purposes. This means that they are subject to capital gains tax when they are sold or exchanged.

The capital gains tax brackets for NFTs are the same as the ordinary income tax brackets. The current tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

How can NFT creators and investors minimize their taxes?

NFT creators and investors can minimize their taxes by carefully tracking their NFT transactions and keeping good records. They should also consult with a tax advisor to determine the best way to structure their NFT transactions. Tools like Ledgible also work to automatically track your NFT purchases and sales so that come tax time, all of your data is in order for tax filing.

How to add NFT Transactions to Ledgible Crypto

NFTs (Non-Fungible Tokens) are a non-interchangeable unit of data stored on a blockchain. This data could be associated with photos, videos or audio. NFT tracking isn’t done automatically on Ledgible, so tracking the activity will be best done manually. Read this full how-to on our help site here.

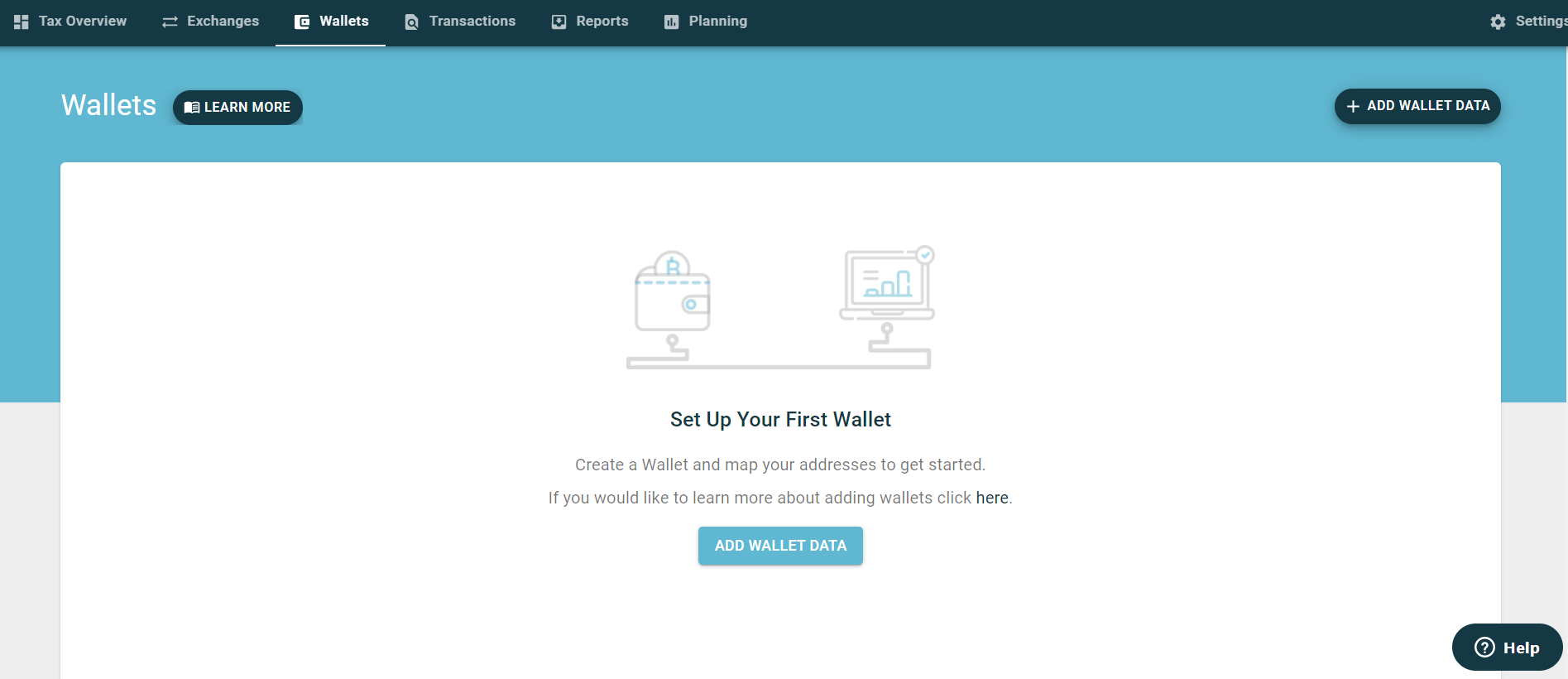

You can start by going to the wallets tab:

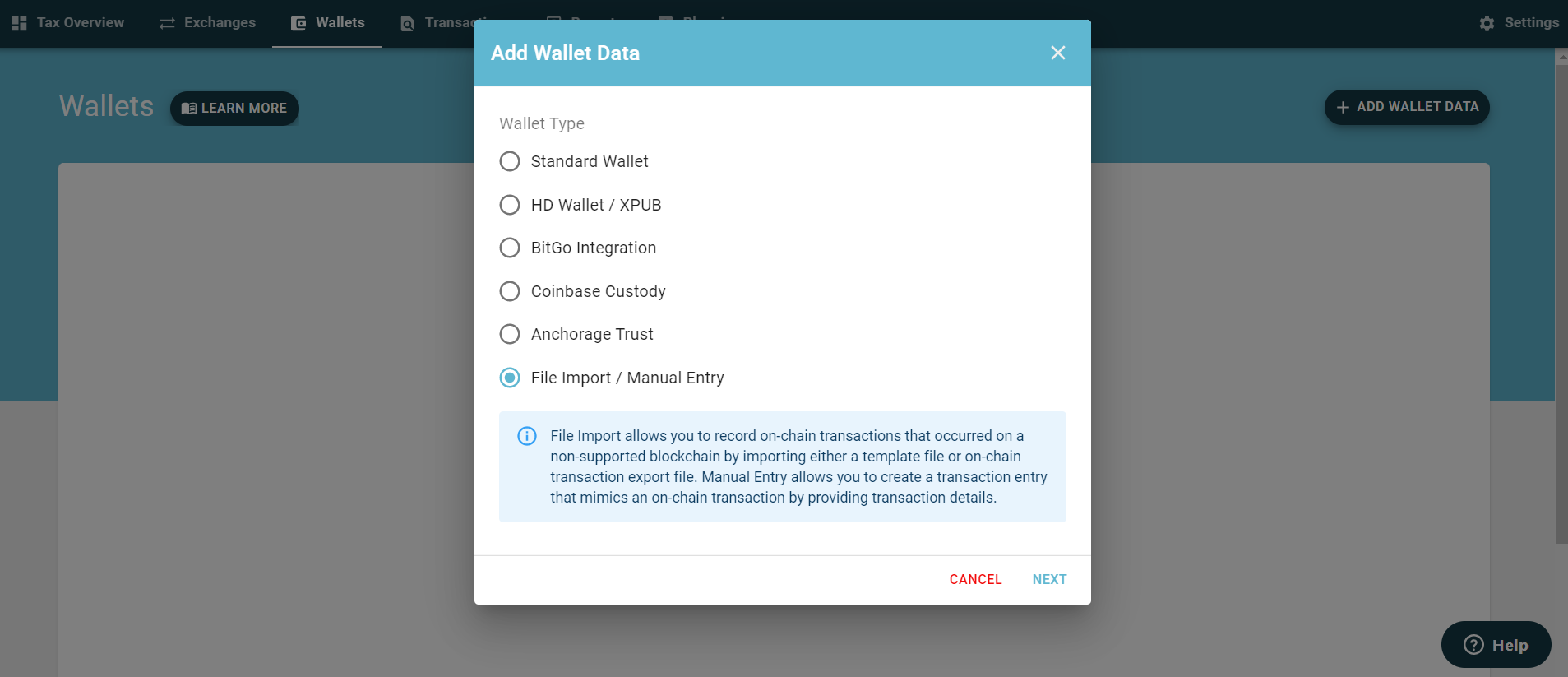

Next click Add Wallet Data and select File Import/Manual Entry and click Next

In addition to manually uploading entries, you are able to download our template and import entries using our file template import:

In the below example, we will go through the manual entry method for minting an NFT. Name your wallet, select NFT and you will have a choice of downloading our file import for many transactions or Manual Entry; we will start with Manual Entry.

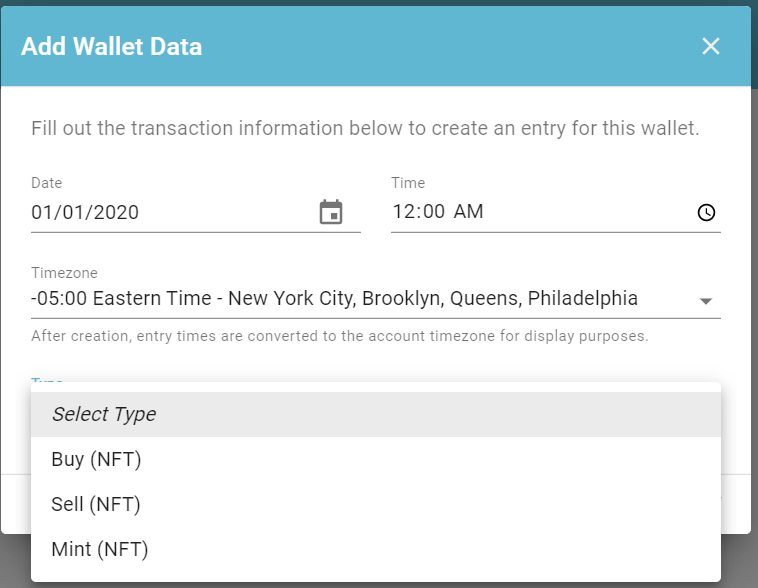

You will have the ability to choose if you are buying, selling or minting an NFT.

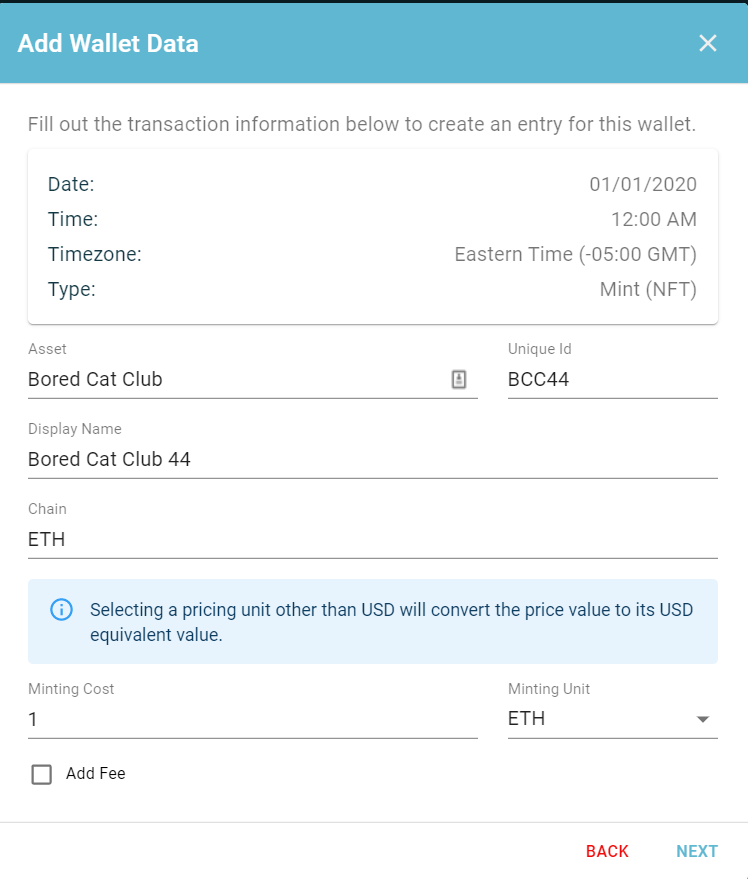

We will go to the next step - in this example I have an asset called "Bored Cat Club" and I have number 44 in the series. It cost me 1 ETH to mint and I had no fees for Minting. If you have fees, you can select and add by clicking on 'Add Fee'.

Finally, click next and create the NFT entry.

To review or add additional entries, select the wallet you just named and click the imports tab.