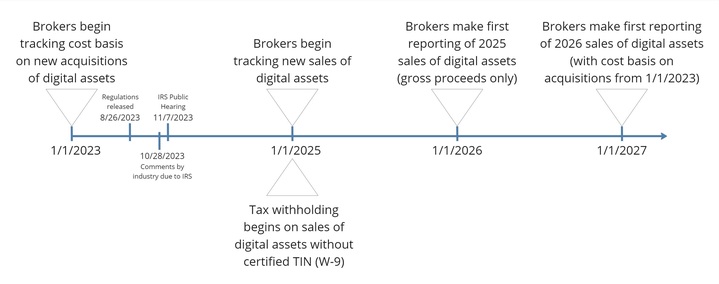

Currently, digital asset reporting will likely be required in 2026 for 2025 transactions meaning brokers have to track new sales of digital assets. You have less than a year to set up 1099 digital asset cost basis tracking. If you and your company don’t have a solution in place by this time next year, it will be too late! See the timeline below

Background

Digital asset tax reporting was first proposed in H.R. 3684 - Infrastructure Investment and Jobs Act in 2021. Prior to this, the financial services industry had a multi-decades long compliance framework for the tax reporting of payments of income and sales of certain financial assets. While some disagreement existed as to whether this existing framework covered crypto and other digital assets, there was a general consensus in the industry that this framework did not provide for enough clarity to ensure consistent application amongst all players that could be in scope of its requirements. Additionally, innovation in the digital assets industry created new providers that were uncertain if they were even in scope at all of this existing framework. Now we have received the proposed regulations on implementing the tax reporting of the sales of digital assets, including the reporting of proceeds of those sales and the cost basis of the sold asset amongst other details. The primary objective of these proposed tax reporting regulations is to close the so-called “tax gap”, which is the difference between tax revenue expected (by the US government) and tax revenue received (through taxpayer compliance). The secondary objective of these proposed tax reporting regulations is to relieve the compliance burden currently resting on the shoulders of the individual taxpayer themselves, who frequently have to pay for the help of tax advisors or crypto tax compliance software in order to properly calculate their taxes.