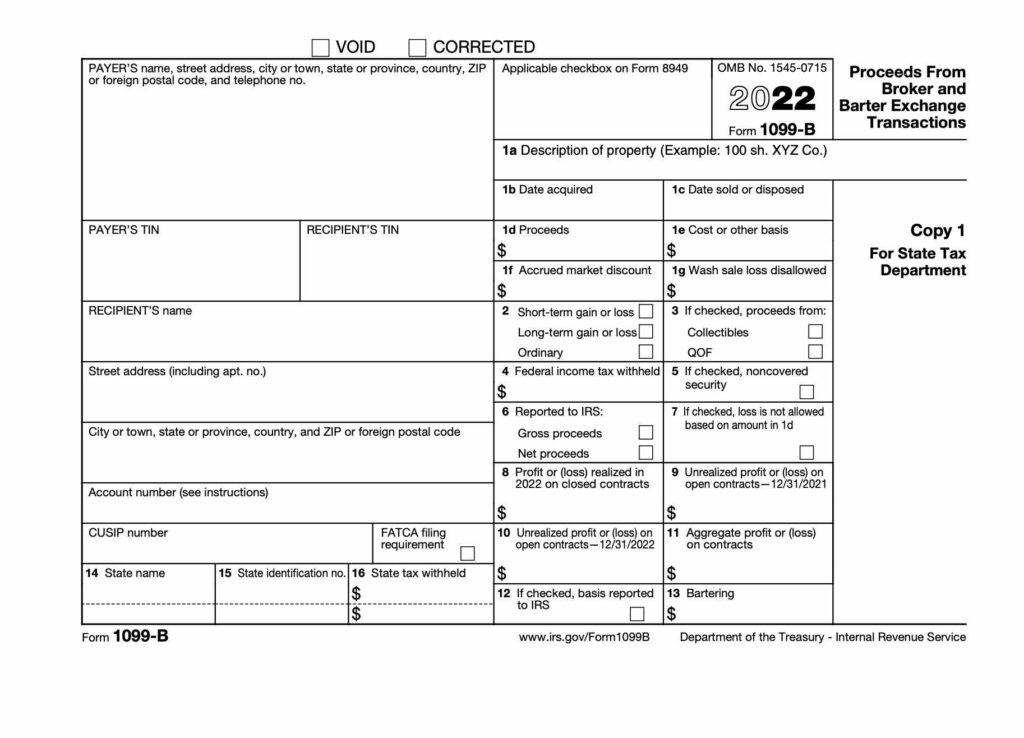

Form 1099B (1099-B) is used to report proceeds from broker and barter exchange transactions. The form is used to report the sale or exchange of property other than stock, including commodities and certain types of property reported on Form 1099-B. This form is also used to report gains or losses from algorithmic trading in commodities futures contracts and foreign currency contracts.

For more information about Form 1099B and how to complete it, please consult the Instructions for Form 1099B from the IRS here.

Please note that the form may be revised periodically and you should always use the most recent version of the form when filing your taxes. You can find the most recent version of the form on the IRS website.

1099B and Crypto

There has been some discussion amongst regulators that 1099-B forms are the correct way to go when mandating reporting from cryptocurrency exchanges. However, there is information captured on 1099B forms that many exchanges may not have, like cost-basis information and gain/loss information. Due to the decentralized nature of cryptocurrency and it's ever-evolving infrastructure, no singular form currently in use by the IRS fits the exact needs of cryptocurrency transactions. Form 8949 is used to report the gain/loss information for cryptocurrency trades, and can be created using the Ledgible Crypto Tax platform.