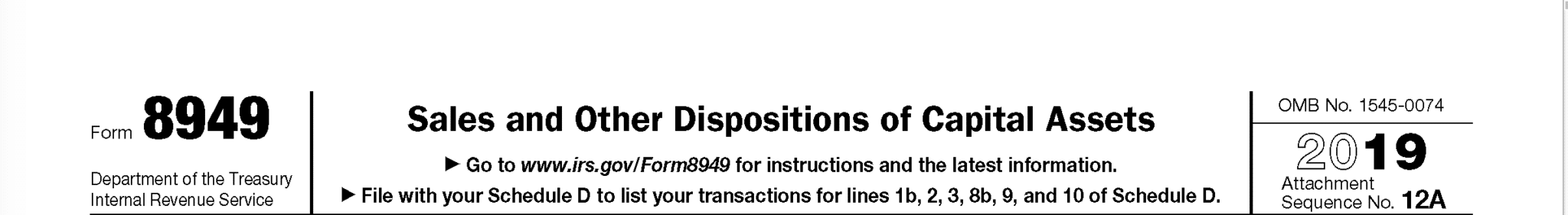

IRS form 8949 is used by taxpayers to report their capital gains and losses for the year. The form is used to calculate the taxpayer's net capital gain or loss for the year, which is then reported on their tax return. Form 8949 must be filed with the taxpayer's tax return if they have any capital gains or losses for the year.

This means that form 8949 is also going to be the place where cryptocurrency users and traders report their cryptocurrency gains and losses throughout the year. But how do you do this? Ledgible offers automated and integrated solutions for cryptocurrency users to generate form 8949 for their holdings and trades. We'll explain how that works below.

Using Ledgible to produce form 8949

As you may know, Ledgible Tax produces many differing report types for use in your Tax filing.

The most standard and recognized of these is the IRS 8949 form - as identified here.

The form contains 2 main sections:

- The first is for Short Term gains/losses that apply to your tax return

- the second is Long Term gains/losses that apply to your tax return

Note: both sections are needed for the complete picture of your taxable cryptocurrency transactions.

The 8949 can be used in many ways:

- it can be attached to you own personally prepared return

- some tax software can import the 8949 form - though it may be better to use the other Ledgible Tax reports that can be directly imported - please take a moment to review those.

- it can be sent to your tax preparer/CPA for them to include in your overall tax return

Final notes

Please note that Ledgible Tax will produce multiple copies of the 8949 form so as to include all cryptocurrency transactions up to 1000 entries. So in the report, please check all pages to be sure you review all of your records past the first two pages if you have many entries.

All you have to do is enter your personal information ( Ledgible Tax does not collect or store your personal information asked for on the form for your privacy ) and use the form to successfully finish your tax return using any of the methods listed above!