Are you planning on filing your taxes with TurboTax this year? This tool is one of the most trusted individual tax filing tools out there, but you might be wondering how exactly to report crypto transactions in your upcoming tax return. TurboTax actually allows users to report their crypto transactions directly in their systems. Here's a quick how-to guide for filing your crypto taxes through TurboTax. This is why Ledgible is the best crypto tax turbo tax integration.

Step 1: Get Started in your TurboTax Account

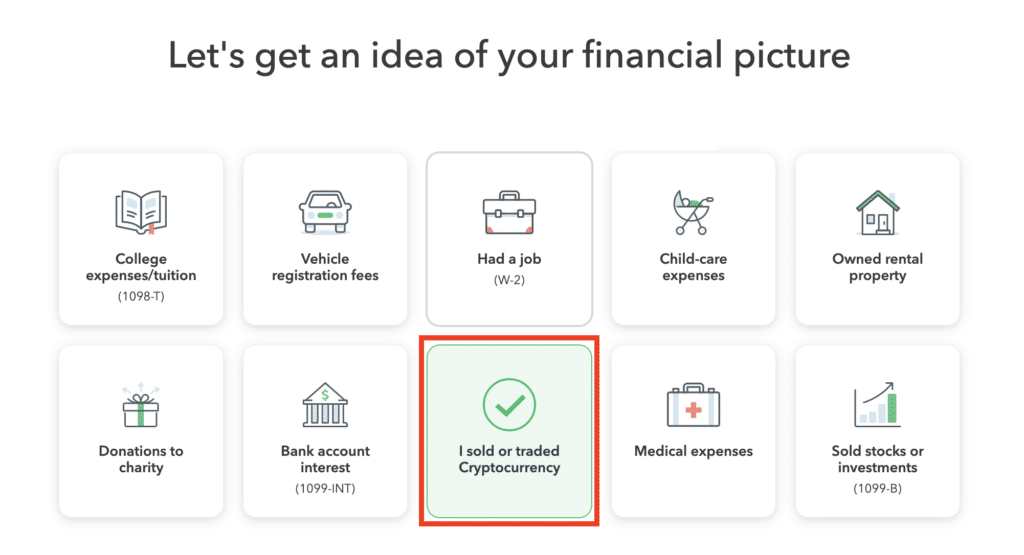

The first start to filing crypto taxes through TurboTax is getting logged into TurboTax and providing all of the necessary underlying tax information. As TurboTax works to gain a better understanding of your tax situation, you will find yourself on a screen that looks something like this:

On this screen, you're going to want to make sure you select the "I sold or traded Cryptocurrency button". This button will tell the tax software that you traded some form of cryptocurrency this year. Don't worry about specifics at this point yet, we'll get to how cryptocurrency is taxed shortly.

Step 2: Click on the Cryptocurrency Section

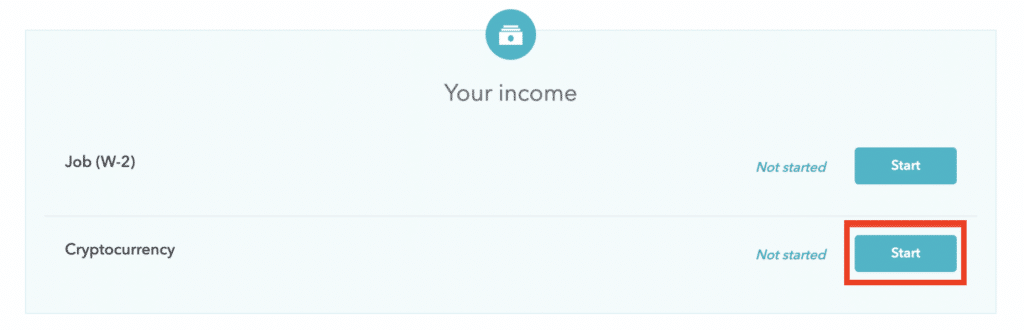

By selecting the option in the previous step about trading cryptocurrency, your TurboTax Income & Expenses dashboard should now be set up to report cryptocurrency. Your Income and Expenses tab should look something like this now:

The cryptocurrency section is where we're going to report out all of the crypto transactions that you might have made in the tax year. Your tab might also say more than just Cryptocurrency, it might say "Stocks, Cryptocurrency, Mutual Funds, Bonds, Other" if you had other investment income that you selected on the previous screen. Don't worry, everything will still work the same.

On the off-chance that your income tab doesn't show the cryptocurrency option, it's likely that you might have missed something in a previous step - but no worries! You can add cryptocurrency here by clicking "Add more Income" in your Income and Expenses tab, then simply select cryptocurrency.

At this point, click the "Start" button in TurboTax, or if you've already been there before, it might say "Edit/Add". Clicking on this button will take you to the cryptocurrency section and allow you to start reporting your transactions.

Step 3: Navigating and Uploading to the Cryptocurrency Section of TurboTax

After clicking on the buttons from the previous step, Turbotax is likely going to ask you whether you traded or sold cryptocurrency in you tax year again. You'll want to answer "Yes" to this question again to make sure all of the necessary steps are followed.

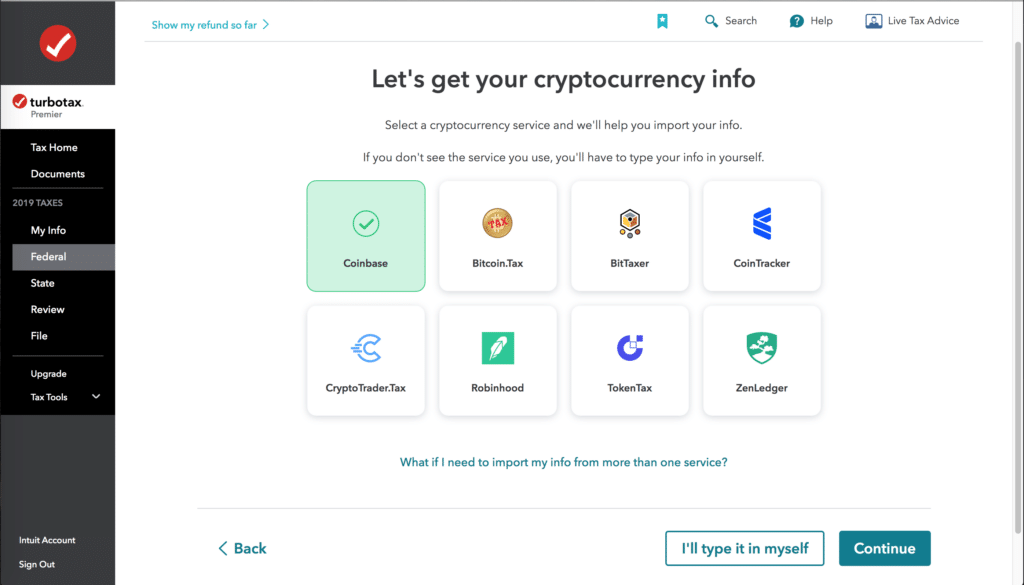

When you arrive at the cryptocurrency information section, you're going to see a screen that looks something like this:

On this screen, you're going to get the opportunity to input all of your trades and transfers from crypto in the past year.

"But what if I use multiple exchanges and don't know all of the transactions I made?"

This is a situation many if not most crypto users find themselves in during tax time. If this is you, Ledgible can help. Ledgible Crypto Tax allows filers to quickly (and securely) connect all of their wallets and exchanges and automatically generate the necessary tax reports, specifically for upload into TurboTax!

You can learn more about Ledgible Crypto Tax and why its the best crypto tax turbo tax integration, here.

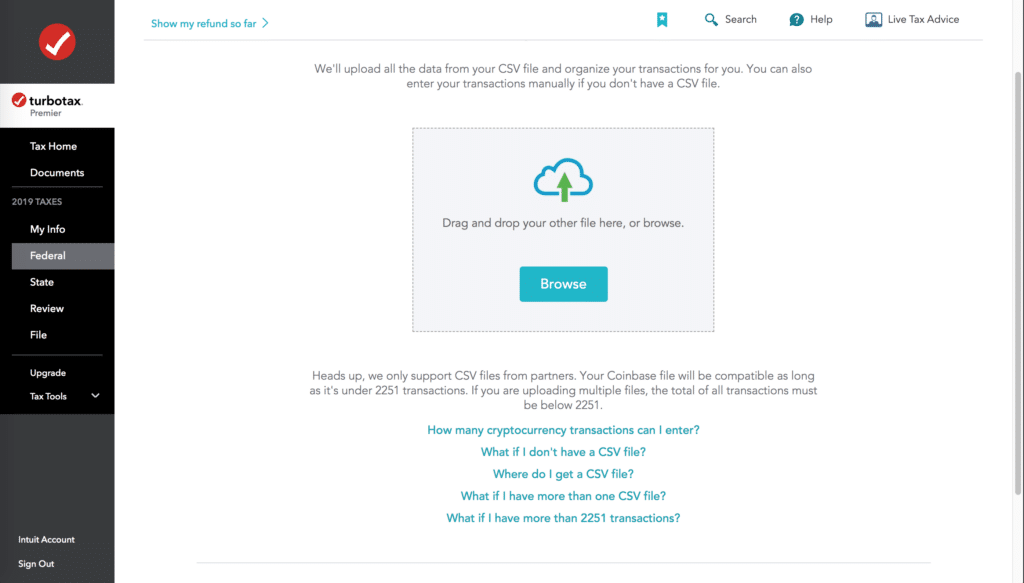

Once you use Ledgible to generate all of your reports, you can import your reports on the crypto screen in TurboTax. You'll land on a screen something like this:

Ledgible Crypto Tax will give you every report you need to upload to TurboTax to document all of your crypto transactions in your existing tax year. Once you upload the reports to TurboTax, the program will automatically compile everything and give you a summary of your cryptocurrency sales that you're going to be taxed on, like this

Once you have everything input and set on this screen, you're all set! You just did everything you needed to do to file cryptocurrency taxes with TurboTax – and Ledgible Crypto Tax makes it as simple as possible. If you don't want to sift through thousands of crypto transactions yourself and manually type them into TurboTax, you're going to want to give it a try. Don't worry, Ledgible is independently audited and fully secure, it can also help you plan your taxes for future tax years so you can set aside enough money to pay the taxes on your "too the moon" gains on Dogecoin.

If you'd like to learn a little bit more about filing your crypto taxes with Ledgible, you can find our ZenDesk article on the topic here. And not to worry, if you would rather a CPA or accountant work on your taxes, Ledgible Crypto Tax Pro is the leading professional solution for crypto taxes. Simply let your CPA know that you'd like to use Ledgible, and they can take over the management of your returns.