Crypto adoption is off the charts, meaning that a record number of people around the world need to file necessary taxes on their gains and losses on bitcoin, ethereum, and other cryptocurrencies. If that's you, and you live in the USA, you're going to need to report those gains to the IRS. Better yet, if you have any losses, you can actually use these to minimize your overall tax burden.

Tax payers will have to pay capital gains taxes on cryptocurrency profits in general, and can deduct any losses from their taxes on their taxes. On occasion, crypto exchanges and other crypto platforms will send out IRS Form 1099, giving you a summary of your transactions during that tax year.

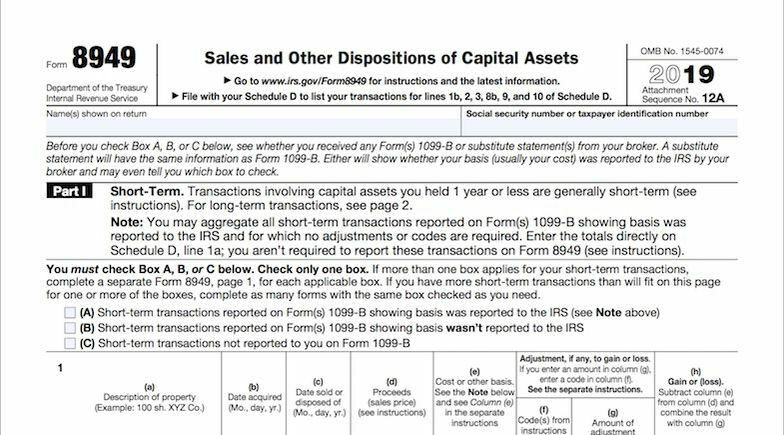

Generally speaking though, your cryptocurrency gains and losses are going to be reported on Form 8949. So what is it?

Understanding Form 8949

How to report cryptocurrency gains/losses

In order to fill out and process form 8949, you're first going to need to have a complete picture of your cryptocurrency transactions. If you don't have a ledger or any other complete documentation of your cryptocurrency transactions, you're going to want to work on compiling that first. For users that use multiple exchanges, have completed complicated swaps or undergone unique-to-crypto events like hardforks or airdrops, you're probably going to want to use a cryptocurrency tax software to compile all of this information.

There are many cryptocurrency tax software products on the market, one of which being the Ledgible Crypto platform. Ledgible is positioned as one of the cheaper options for tax filers, and has extensive use-cases for institutional and professional tax preparers. Thanks to Ledgible integrations with nearly every tax software in existence, Ledgible makes compiling crypto transactions, producing form 8949, and filing taxes on your cryptocurrency transactions a breeze. You can learn more about Ledgible here.

Back to form 8949 - to fill out the form, you're going to need to understand the date you bought and sold a cryptocurrency, as well as the prices you bought and sold those currencies for. It's this gathering of data that makes the use of a cryptocurrency tax software the preferred solution - it can be quite the headache otherwise.

You'll also need to denote on the form whether you held the property for less than a year or over a year, as this will impact the tax rate that you pay on the holding - long term or short term capital gains taxes.

The information needed for form 8949 in detail

We mentioned some of the information you'll need to fill out the form for cryptocurrencies in the section before, but we've compiled everything into a simple list below:

- The name of the asset

- The time you bought the asset

- when you sold the asset

- The price of the asset when you bought it

- The price of the asset when you bough it

- The gain or loss (calculated by using number 4 and number 5)

Chances are for casual tax filers, this is already more work than you're used to doing for your taxes. Again, underscoring the importance of a good cryptocurrency tax software, like Ledgible. Another possibility is going to a professional accountant or tax preparer and having them compile this information. Ledgible is the leading professional crypto tax software too, so chances are if you go to work with a tax professional, you'll also use the Ledgible platform for all of your crypto data aggregation needs as well.

What if I don't have the information needed for the form?

Starting in 2024, all crypto exchanges will be required to send out 1099 and appropriate tax forms to crypto traders. However, because that regulation hasn't been put into place yet, chances are crypto traders don't have all of the information necessary for compiling form 8949 - which can create a number of headaches for tax filers and professionals alike.

In order to gather this data, you essentially have 2 options:

- Manually go into your exchanges, collect the data, and compile it into a spreadsheet

- Automatically import your transaction data using the Ledgible Crypto Tax platform.

One of these options involves hours of work in Microsoft Excel. The other involves about 20 minutes of automated connections. You be the judge of which process you'd like to go with.

Reporting gains on cryptocurrency

Simply trading cryptocurrency isn't the only way that you'll encounter a situation where you'll need to file form 8949 on your cryptocurrency activity. If you do more complex operations like staking, undergo a hard fork, or even simply trade or exchange crypto for one or another, these events are all considered taxable under current IRS regulations.

The IRS has not taken a firm stance on how taxpayers should treat cryptocurrency, rather leaving it up to a matter of opinion for specific use-cases for professional accountants. One thing the IRS has been clear on is that cryptocurrency is considered taxable, meaning that taxpayers have to at least engage in the process of filing taxes on cryptocurrency trades.

A summary

In summary, IRS Form 8949 is used to report capital gains and losses, allowing the IRS to quickly document your taxable gains and record them properly. Form 8949 is also used to ensure that any capital losses you had from cryptocurrency are appropriately used to minimize your overall tax burden.