As tax teams prepare for an evolving regulatory environment, the challenges of accurately reporting cost basis data for digital assets have never been more pressing. From tracking high-volume transactions to reconciling varying cost basis methods, digital asset tax reporting continues to raise questions—and expectations—for professionals in the space.

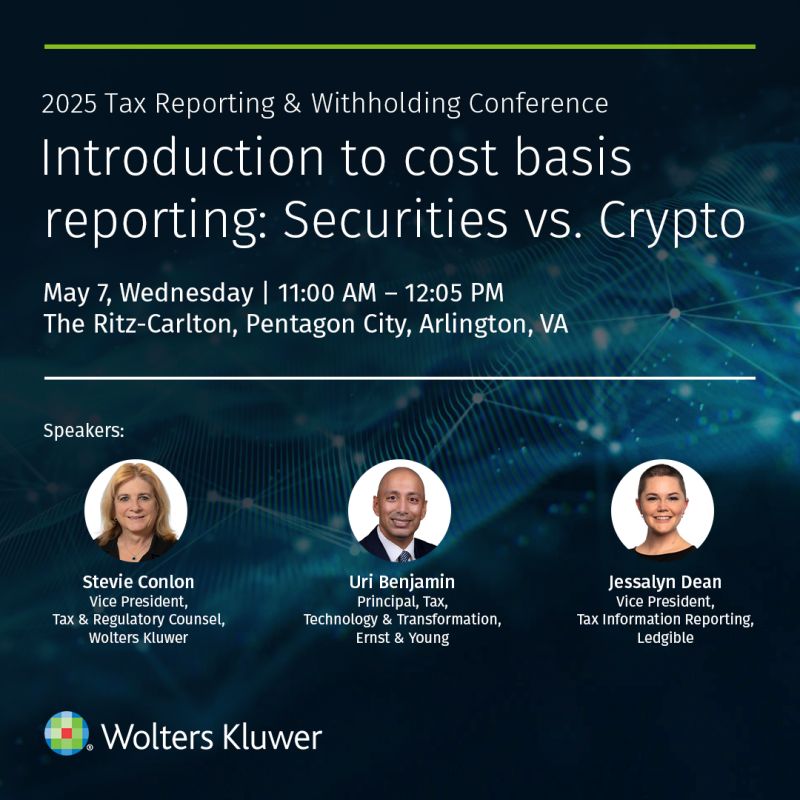

That’s why we're excited to highlight an important panel discussion at the 2025 Tax Reporting & Withholding Conference in Washington, D.C. This session, “Introduction to Cost Basis Reporting – Securities vs. Crypto,” brings together key industry voices to unpack the nuances of this critical compliance topic.

Panelists include:

- Stevie Conlon, Vice President and Tax and Regulatory Counsel at Wolters Kluwer

- Uri Benjamin, Executive Director at EY

- Jessalyn Dean, Vice President of Tax Information Reporting at Ledgible

Together, these experts will examine:

- Key similarities and differences between securities and crypto cost basis reporting

- How digital assets challenge traditional tax reporting frameworks

- What the upcoming Form 1099-DA and IRS regulations mean for compliance teams

The session will provide actionable insights for tax professionals looking to stay ahead of new regulations and ensure accurate, efficient reporting practices.

🗓️ Date: Wednesday, May 7

🕚 Time: 11:00 AM – 12:05 PM ET

📍 Location: The Ritz-Carlton, Pentagon City, Arlington, VA

Ledgible is proud to sponsor this event and support the conversation around clarity and innovation in digital asset tax reporting.

👉 Learn more and register here: https://ow.ly/bJM050VJFyI