Table of contents

- Highlights

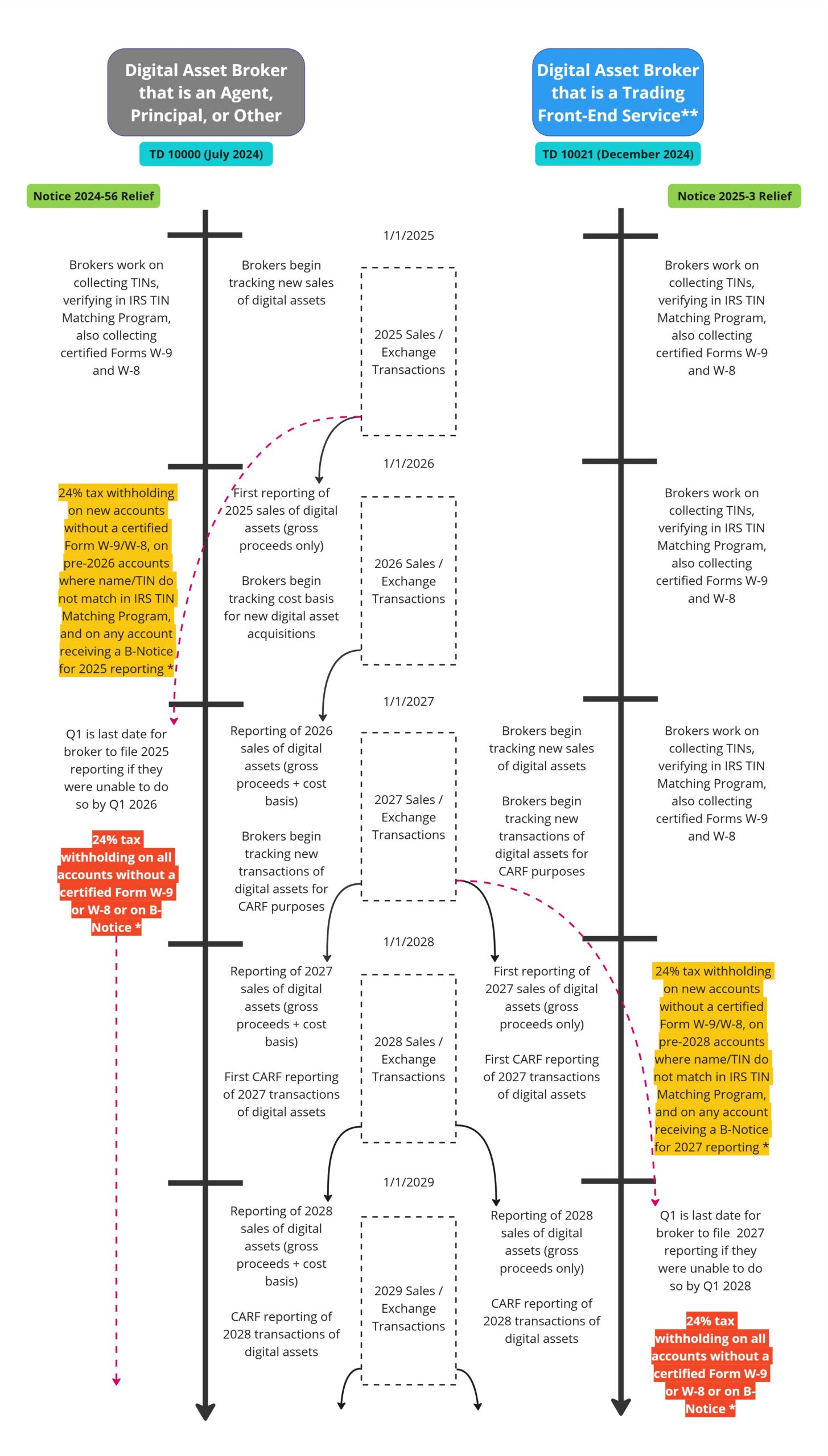

- Timeline

- Key Findings for Digital Asset Service Providers

- Reduced Scope of Digital Asset Middleman Definition

- Form 1099 Reporting

- Tax Withholding Requirements Remain

- Transitional Relief For Brokers - Notice 2025-3 - Tax Withholding & Filing Deadlines

- Transitional Relief For Brokers - Notice 2024-57 - Deferral of Tax Withholding & Reporting for Certain Transactions

- Key Findings for Taxpayers & Their Advisors

- Reactions from Ledgible Experts

- Missing Regulations, Guidance, and Clarity

- Who is Ledgible, How Can We Help

- Disclaimer

[The "Trading Front End Services" definition was repealed in April 2025 and information in this blog post may be out of date]

On December 27, 2024, the crypto and digital assets industry received the long awaited final regulations seeking regulatory clarity and improving taxpayer compliance with regards to sales, exchanges, transfers, and payment processing involving digital assets through decentralized finance (“DeFi”) providers. Additionally, supplemental transitional relief and guidance was issued in the form of Notice 2025-3. At Ledgible, we summarized the proposed regulations in August 2023, submitted our public comment letter to the IRS addressing our feedback, provided our expert testimony at the IRS public hearing in November 2023, and published a whitepaper on the impacts of the "non-DeFi" final regulations in July 2024. With these final regulations published in December 2024, the IRS confirms certain DeFi providers as digital asset brokers required to comply with Form 1099-DA tax reporting and withholding requirements. Further guidance and clarity is still needed in many areas of the regulations.

At Ledgible, we will continue our work through comment letter submissions to the IRS and US Treasury, industry collaborations, and working groups. We suggest reading our July 2024 whitepaper to form the basis of the rest of this deep-dive analysis into the final regulations for DeFi providers.

By: Jessalyn Dean, VP of Tax Information Reporting at Ledgible

Highlights

- Broker Definition for Digital Asset Middleman (“DeFi Brokers”): the broad definition of Digital Asset Middleman has been significantly reduced from the proposed regulations to apply to “trading front-end services” with further clarity and examples provided. This removes from the definition of broker: blockchain application layers, blockchain protocols, internet service providers, and other kinds of possible providers in decentralized sales/exchanges of digital assets that are not a Trading Front-End Service (a newly defined term). Though the data is unreliable, the IRS estimates that between 650 and 875 digital asset providers will meet the definition of being a Digital Asset Middleman required to do tax withholding and reporting on Form 1099-DA.

- Not Just for DeFi: while it is convenient to call these the “DeFi Broker regs”, the terms “DeFi” and “decentralized" are not used in the regulations themselves. Instead, these “Middleman” regulations apply to any provider in a trade or business of effecting sales/exchanges of digital assets who is generally not a principal or agent to the transaction. This is meant to capture the DeFi industry but more broadly it can apply to non-DeFi providers that did not find themselves captured in the broker definition by the final regulations package from July 2024.

- Timeline & Transitional Relief: a deferred timeline for reporting gross proceeds is introduced which delays the application to Trading Front-End Services by two years compared to other broker types (e.g. centralized exchanges). The IRS offers penalty relief to Trading Front-End Services that cannot meet their obligations on time but can demonstrate that they acted in a good-faith manner with their best efforts to comply. The timeline is presented later in this analysis.

- Tax Withholding & Transitional Relief: though DeFi providers do not have control or custody of their customers' funds, the IRS remains steadfast in their requirement for any broker to withhold taxes when it is required (e.g. the absence of a valid taxpayer identification number or TIN). In the IRS view, these Trading Front-End Service providers can change their software code to be able to withhold taxes. Phased in backup withholding requirements in the final regulations bring relief to brokers who need to properly document their customers on a certified Form W-9, Form W-8, or appropriate substitutes. The timeline is presented later in this analysis.

- Applicability of Cost Basis Tracking, Calculation & Reporting: there is no exemption from the tracking, calculating, and reporting of cost basis information specifically carved out for Digital Asset Middlemen. However, in the majority of cases these DeFi providers (i.e. trading front-end services) will not be providing custodial services and therefore the sales/exchanges that they need to report are not covered assets. Only gross proceeds reporting will be required in these cases.

- Deferred Application to Non-US DeFi Providers: under the July 2024 final regulations package, the IRS deferred the application of Form 1099-DA reporting on sales/exchanges of digital assets for non-US brokers until the IRS can address the implementation of the international tax model called the CARF. This deferral also applies to DeFi providers addressed in this analysis. However, it is important that DeFi providers of Trading Front-End Services make an assessment under the rules of what constitutes being a US vs non-US digital asset broker as it is a defined term that requires a nuanced analysis of the facts and circumstances of each provider.

- No Comment Period or Public Hearing: the proposed regulations were issued in August 2023 which triggered over 44,000 public comments and a public hearing in front of the IRS and US Treasury. The regulations summarized in this analysis are final and therefore have no comment period or public hearing. The public can still contact the IRS with feedback and concerns.

Timeline

* Until further guidance is issued, tax withholding is postponed on certain sales/exchanges of Specified NFTs, certain real estate transactions, and PDAP transactions.

** This timeline assumes that the Digital Asset Middleman is not providing custodial services which should be the most typical scenario. Also important to note that this timeline is only for Digital Asset Middlemen that are Trading Front-End Services. All other Digital Asset Middleman types fall into the earlier timelines.

Please note that not all relevant dates are mentioned in this timeline overview, including those applicable to documentation of exempt foreign payees, and those applicable to issues pending further guidance.

Key Findings for Digital Asset Service Providers

When the IRS published the proposed digital asset tax reporting regulations in August 2023, the definition of broker captured providers in a trade or business of effecting sales/exchanges of digital assets on behalf of a “customer”. A customer was defined into 4 types generally consistent with the definition for sales/exchanges of traditional securities. This customer definition meant a person, other than the provider themselves, if the provider acts as:

- An agent for the sale (e.g. a fiduciary type intermediary),

- A principal for the sale (e.g. a direct counterparty selling from their own inventory),

- A participant responsible for paying the customer or crediting their account (e.g. middlemen such as a custodian or transfer agent), or

- A digital asset middleman (e.g. other participants that may bring buyers/sellers together)

- Certain payment processors, real estate transactions, and physical kiosks

- Others effecting services

In finalizing the regulations, the IRS decided to publish in July 2024 the non-DeFi regulations which applied to the first three types and type 4(a). The IRS deferred finalizing the 4(b) type Digital Asset Middleman until further notice. With this second wave of final regulations in December 2024, the IRS finalized the application of the July 2024 regulation package to the 4(b) type: Digital Asset Middlemen that are Trading Front-End Services.

Reduced Scope of Digital Asset Middleman Definition

Most DeFi providers were not captured by the July 2024 non-DeFi regulations because in most cases they are not acting as an agent nor as a principal in the sale, nor are they paying/crediting the account of a customer. As such, they were put on hold as potential Digital Asset Middlemen until now.

The broad definition of Digital Asset Middleman from the proposed regulations (issued in August 2023) that could have applied to DeFi under 4(b) above has been significantly reduced to only apply to Trading Front-End Services. Below is a table comparing the proposed definition and the final definition. For DeFi providers that meet this broker definition, they will be obligated to comply with tax withholding and Form 1099-DA reporting requirements which we outlined in great detail in our July 2024 whitepaper analysis.

| Proposed Regulations (August 2023) | Final Regulations (December 2024) |

| A broker includes a digital asset middleman | A broker includes a digital asset middleman |

| A digital asset middleman is anyone providing a facilitative service… | A digital asset middleman is anyone providing an effectuating service… |

| A facilitative service is any service that directly or indirectly effectuates a sale of digital assets… | An effectuating service is any service with respect to a sale of digital assets that is a trading front-end service… |

| ...which is a service that: - provides a party in the sale with access to an automatically executing contract or protocol; - provides access to digital asset trading platforms; - provides an automated market maker system; - provides order matching services; - provides market making functions; - provides services to discover the most competitive buy and sell prices; or - provides escrow or escrow-like services to ensure both parties to an exchange act in accordance with their obligations. | … which is a service that: receives a person’s order to sell and processes that order for execution by providing user interface services, including graphic and voice user interface services, that are designed to: i. enable such person to input order details with respect to transactions to be carried out or settled on a distributed ledger or similar technology; and ii. transmit those order details so that the transaction can be carried out or settled on a distributed ledger or similar technology, including by transmitting the order details to the person’s wallet in such form that, if authorized or signed by the person, causes the order details to be transmitted to a distributed ledger network for interaction with a digital asset trading protocol. |

Largely unchanged from the proposed regulations, a “facilitative service” or an “effectuating service” by a Digital Asset Middleman also includes services such as payment processing in digital assets, facilitation of the sale of real estate, and operating physical terminals/kiosks that accept digital assets which were identified earlier in this section under broker type 4(a). Excluded from a “facilitative service” or an “effectuating service” are blockchain network validation services, the licensing of software to control private keys, and the selling of hardware to control private keys.

While unhosted wallet software fits into this exclusion from “effectuating services”, such wallet providers may come into scope as a Digital Asset Middleman if they provide a Trading Front-End Service. Fortunately, such wallet providers will only be in-scope of broker reporting for sale/exchange transactions that are associated with their Trading Front-End Service and not all transactions associated with the wallet they provide.

In the commentary of the final regulations, the IRS presented lengthy rationale for their scaling back the definition of Digital Asset Middleman. This commentary focused on explaining how the traditional securities industry works with a key focus on the effecting of sales/exchanges through three processes: trade communication, execution, and settlement. The commentary then went on to compare the DeFi ecosystem to the traditional securities industry. Below is a simplified table illustrating these three layers as presented by the IRS commentary:

| Traditional Securities | DeFi | |

| Trade communication (request) | Broker | Interface layer * Front-end services ** and customer buttons, sends instructions in coded data objects to the application layer, can include DeFi aggregator platforms |

| Trade execution (matching buyer/seller) | Exchange | Application layer * DeFi protocols that consist of automatically executing contracts, also generally includes DAOs |

| Trade settlement (final asset movements) | Clearing house | Settlement layer Network validators / block builders. Record financial transactions on the distributed ledger. Immutable / irreversible. |

* It is important to note that the use of “Interface Layer” and “Application Layer” by the IRS are not consistent with typical industry terminology and may cause confusion for blockchain-knowledgeable readers. For the purpose of this analysis, we have used the IRS defined terms so that the reader can easily locate the IRS commentary in the final regulations.

** As discussed earlier, unhosted wallet software providers that offer Trading Front-End Services are in-scope as a Digital Asset Middleman.

The IRS presented this comparison in order to arrive at their rationale for only bringing Trading Front-End Services (the “trade communication layer” in this table) in-scope of the broker type Digital Asset Middleman. DeFi participants in the other two layers, the execution (application) and settlement layers, are not in-scope as a broker because they are not a principal or agent to the sale/exchange and because they are not a Digital Asset Middleman offering a Trading Front-End Service to customers. For comparison purposes, the broker definition that applies to the traditional securities industry explicitly excludes exchanges (execution layer) and clearing houses (settlement layer).

Further rationale as to why Trading Front-End Service providers (the “trade communication layer” in the table) are the DeFi participant layer that are in-scope as Digital Asset Middleman brokers is provided by the IRS as follows:

- such providers are the DeFi participants that have the closest relationship to customers and therefore are in the best position to obtain customer identification information.

- such providers can change their software as it is not immutable.

- such providers responsible for carrying out customer identification and reporting will be legal entities that are easy for taxpayers and the IRS to identify, and these providers have the capability to modify their operations to comply with these regulations. Their customers sign up to use their website and agree to terms and conditions in using the software.

- such providers are the DeFi participants that provide services that are most analogous to the functions performed by brokers in the traditional securities industry.

Form 1099 Reporting

Here is an abbreviated list of information that will be reported on IRS Form 1099-DA by a Digital Asset Middleman that is a Trading Front-End Service:

- Customer’s name, address, and TIN;

- Name or type of the digital asset sold and the number of units sold;

- Sale date using UTC;

- Gross proceeds of the sale;

- Whether the consideration received was cash, different digital assets, other property, or services;

- For Specified NFTs, to the extent ordinarily known, the portion of the total gross proceeds reported that is attributable to primary sales;

- Tax withheld, if any;

A more detailed discussion of the Form 1099-Reporting requirements can be found in our July 2024 whitepaper analysis, including collection and retention (but not reporting) of transaction ID and wallet address, reporting exemptions and de minimis thresholds, and cost basis information (also discussed later in this analysis).

Tax Withholding Requirements Remain

Though DeFi providers typically do not have control or custody of their customers' funds, the IRS remains steadfast in their requirement for any broker to withhold taxes when it is required. This is because tax withholding forms the backbone of Form 1099 reporting in order to incentivize the customer (i.e. taxpayer) to provide their complete and valid TIN.

More details about collecting personal tax data on Forms W-9 and W-8, and the related tax withholding issues, can be found in more detail in our July 2024 whitepaper analysis.

Transitional Relief For Brokers - Notice 2025-3 - Tax Withholding & Filing Deadlines

At the end of a transition period, all Trading Front-End Services brokers will be required to have a certified Form W-9, W-8, or appropriate substitute forms on file for their customers in order to avoid having to withhold certain US taxes. In recognition of the time that is needed to implement systems to collect and validate these forms, the IRS has offered Trading Front-End Services the implementation relief discussed below which is similar to the relief and transition period offered to other broker types (e.g. centralized exchanges acting as agent or principal) in Notice 2024-56, but with different dates.

First, this notice provides a phased-in approach for applying backup withholding of 24% to US Persons which is portrayed in the timeline presented earlier in this analysis. Critical to this approach is the implementation and use of the IRS TIN Matching Program by brokers and demonstrating good faith efforts to document their payees on a Form W-9. During the phase-in and in lieu of a certified Form W-8 on file, a Trading Front-End Service can treat an account as an exempt foreign person for accounts established prior to January 1, 2028, for sale/exchange transactions effected prior to January 1, 2029, so long as the account has not been previously identified as a US Person and there is no US residence address on file.

Second, this notice provides relief from certain failure to deposit penalties for tax withholding that was required to be collected and deposited to the IRS, in which the full amount could not be deposited due to a decrease in the value of the digital asset withheld in the transaction. This relief only applies to sale/exchange transactions before January 1, 2029 where the Trading Front-End Service immediately liquidates the withheld digital assets for fiat cash.

Third, this notice provides penalty relief for brokers that cannot timely file Form 1099-DA in the first year but demonstrate good faith efforts to have done so. The first reporting of gross proceeds by Trading Front-End Services over 2027 transactions is due in Q1 2028. If the Trading Front-End Service cannot file on time (Q1 2028) then they have until Q1 2029 to file these returns. In such a case, the Trading Front-End Service would be reporting two years of returns at once: both 2027 transactions and 2028 transactions. However, in the case that the IRS approaches a broker for an audit exam before the filing of such late returns, then penalty relief may not be available.

Lastly, though not covered in this notice, Trading Front-End Services may also postpone tax withholding until further guidance is issued related to certain non-fractionalized digital assets such as certain NFTs, certain PDAP payments, and certain real estate transactions. This is covered in the earlier Notice 2024-56 and applies to all brokers, whether they are Trading Front-End Services or otherwise.

Transitional Relief For Brokers - Notice 2024-57 - Deferral of Tax Withholding & Reporting for Certain Transactions

Though this notice was issued in July 2024, it applies to all brokers. Until IRS and Treasury have studied the following transactions more deeply and issued final guidance, there is no tax withholding, cost basis, or gross proceeds reporting on the following six transaction types in the context of sales/exchanges/transfers:

- Wrapping and unwrapping transactions;

- Liquidity provider transactions;

- Staking transactions;

- Transactions described by digital asset market participants as lending of digital assets;

- Transactions described by digital asset market participants as short sales of digital assets; and

- Notional principal contract transactions.

Key Findings for Taxpayers & Their Advisors

Though the primary focus of this analysis is on the broker perspective, we highlight here a few key points on the impact for the customers of the brokers (i.e. taxpayers):

- Given the delay in Form 1099-DA reporting for Digital Asset Middlemen, with first Forms being issued and provided to taxpayers in Q1 2028 over 2027, taxpayers and their advisors will have a long runway of being vigilant in tracking their own sales/exchanges/transfers of decentralized digital asset transactions. Compare this with Forms 1099 that taxpayers will receive from centralized exchanges which will arrive two years earlier in Q1 2026 over sales/exchanges effected in 2025.

- Most, if not all, Forms 1099-DA issued by DeFi providers will never report cost basis information because they do not provide custodial services. As such, it is up to taxpayers and their advisors to track, calculate, and report on the missing cost basis for these transactions.

- Taxpayers should be aware that even where a transaction has not been reported due to delayed implementation, de minimis thresholds, or reporting exemptions applicable to the broker, it may still be a reportable and taxable event to them. This could occur, for example with certain sales of de minimis reporting on Specified NFTs, de minimis reporting on PDAP Sales, de minimis reporting on Qualifying Stablecoins, exempted reporting on Qualifying Stablecoins, asset wrapping and unwrapping, lending, short sales, liquidity provider transactions, staking, mining, airdrops, closed loop gaming transactions, and more.

- Due to transitional relief provided to brokers in Notice 2025-3, taxpayers may receive some Forms 1099-DA late. Specifically, brokers that are Trading Front-End Services have some relief for reporting 2027 transactions in Q1 2028 if they demonstrate best faith efforts to comply. In such a case, they can report 2027 transactions as late as Q1 2029. As all impacted taxpayers would have filed their 2027 taxes by then, they may need to file an amended return to account for variances.

- The regulations adopt UTC as the time zone to use for Form 1099-DA reporting purposes. However, the IRS has been silent on any clarity about how a taxpayer would reconcile incorrect Forms 1099. By way of example, if Taxpayer A sells Asset B at 10pm Eastern on December 31 Year 1 which is 3am UTC on January 1 Year 2, then the broker must report the sale on a Year 2 Form 1099-DA. Taxpayers will have to figure out on their own, with the help of a tax advisor, how to reconcile reporting and pay taxes on the sale in Year 1 in their Form 8949 while they receive a Form 1099-DA in the following Year 2 for that sale.

Reactions from Ledgible Experts

Understanding The Role of the Broker Is Critical (Agent, Principal, or Middleman)

As mentioned earlier, most DeFi providers were not captured under the broker definition in the July 2024 regulation package because they are not acting as an agent nor as a principal in the sale, nor are they paying or crediting a customer account. Instead, as was discussed earlier, the majority of DeFi providers that will now fall into the broker definition as a Digital Asset Middleman do so because they are providing a Trading Front-End Service. It is important for a digital asset provider to understand which of these roles they have in a sale/exchange transaction because the timelines apply to them differently in two waves, as depicted in the earlier timeline section of this analysis.

Looking closer at the cost basis rules, we see in the final December 2024 regulations package that the IRS did not provide a specific exemption from the tracking, calculating, and reporting of cost basis information for Digital Asset Middlemen (i.e. DeFi Trading Front-End Services). Cost basis reporting is required when the asset that is sold/exchanged is a so-called “covered security” (or “covered asset”) which is defined as an asset that is “acquired in a customer’s account by a broker providing custodial services”. Said differently, for an asset to be a covered asset it must be acquired/purchased, held, and sold/exchanged within the same custodial account. Later, a covered asset will also include those transferred-in assets for which the broker received a cost basis transfer statement, however the IRS has not given an indication of when they will publish this guidance and its applicable start date. Below is a table highlighting some of these distinctions with a few example scenarios.

| Non-Exhaustive Examples for Comparison Purposes | Acquired/ Purchased at Broker | Not Acquired/ Not Purchased at Broker | First Gross Proceeds Reporting |

| If Agent/Principal… And centralized exchange with hosted wallet services (either directly or through third party provider) | Covered Asset, Cost basis reporting required | Non-Covered Asset Will be Covered Asset in the future once cost basis transfer regulations issued | Q1 2026 over 2025 transactions, gross proceeds only Q1 2027 over 2026 transactions, gross proceeds + cost basis for covered assets only |

| If Agent/Principal… And OTC desk trading via self-hosted wallets | Not Applicable | Non-Covered Asset | Q1 2026 over 2025 transactions, gross proceeds only |

| If Middleman…(Not Agent/Principal) Trading Front-End Services never taking any custody of assets | Not Applicable | Non-Covered Asset | Q1 2028 over 2027 transactions, gross proceeds only |

| If Middleman…(Not Agent/Principal) Trading Front-End Services with momentary* custody of asset during deployment of software code | Not Applicable | Non-Covered Asset Will be Covered Asset in the future once cost basis transfer regulations issued | Q1 2028 over 2027 transactions, gross proceeds only + Cost basis for covered assets only at some unknown time in the future pending cost basis transfer regulations |

* Whether momentary custody of an asset constitutes an agency relationship is outside the scope of this analysis but is a concept worth considering as the earlier first wave reporting deadlines would apply instead. For this example, we have assumed that such momentary custody does not constitute an agency relationship.

A supplemental diagram is provided below illustrating the importance of understanding the role of the digital asset provider in determining various outcomes and their obligations under the final regulations:

Tax Withholding Without Control or Custody of Funds

The IRS expects that DeFi Trading Front-End Services can and should modify their software code and smart contracts to withhold taxes, where it is required. Tax withholding can be required where customers fail to provide any TIN to the broker, customers provide a clearly invalid TIN, customers do not certify their TIN where required to, or the broker receives a B-Notice from the IRS to begin backup withholding, amongst others. The alternatives to withholding taxes are:

- the DeFi provider pays the withholding taxes out of their own pocket which is not sustainable but occasionally occurs in the traditional securities industry by exception; or

- block customers from transacting on the platform if there is an indication that tax withholding is required. Note that this option is not available for centralized exchanges (for reasons which are outside the scope of this discussion) and is not a long-term viable solution.

In deferring tax withholding obligations set out in Notice 2025-3, the IRS indicated that these providers will need sufficient time to modify their Terms & Conditions (legal agreements with their customers) and modify their software code. Trading Front-End Services will be starting from ground zero in building a very important infrastructure to support the secure acquisition, validation, retention, retrieval, and reporting of sensitive customer personal tax data.

Notes of Interest and Industry Shockwaves

- The collection of personal data about customers, tax withholding, and tax reporting to the IRS is a landmark moment for the DeFi industry which will have huge implications through its fabric of existence.

- It is uncertain how lawsuits against the US Treasury and IRS will impact these regulations, including any flaws in technical DeFi ecosystem understanding that the final regulations may have relied upon. Lawsuits have already been filed by the Blockchain Association. More lawsuits could be filed in the coming weeks.

- It is uncertain how the overturning of the Chevron case by the US Supreme Court and the change in US Presidency administration will impact these regulations, other pending guidance, and the adoption of CARF by the US.

- DeFi providers should keep in mind that definitions/terminology under IRS regulations can and will be different to those used by FinCEN, OECD, CFTC, SEC, FATF, and more. A DeFi provider being a “broker”, “agent”, “middleman”, etc. under IRS regulations does not mean that they are a broker, agent, or middleman to the SEC or other agencies.

Missing Regulations, Guidance, and Clarity

There is still far more guidance to come, for example:

- Final Form 1099-DA, final broker instructions, and composite form reporting

- Revised Form W-9s for US payees, with exempt recipient for certain digital asset brokers

- Revised Form W-8s for foreign (non-US) payees

- Revised Form 8949, Schedule D, and associated instructions

- Tax withholding requirements for PDAP Sales, sales of specified NFTs, and real estate transactions that were deferred in Notice 2024-56

- Tax withholding and reporting requirements for sale/exchange transactions that were deferred in Notice 2024-57 (wrapping and unwrapping transactions; liquidity provider transactions; staking transactions; lending of digital assets; short sales of digital assets; and notional principal contract transactions)

- Multiple Broker rule examples in the DeFi ecosystem

- Intended exemption from reporting of redemptions of receipt tokens used only to keep track of voting history

- 6045A transfer reporting and 6045B reporting of actions affecting cost basis, including what types of actions in blockchain affect the basis of an asset

- Crypto-Asset Reporting Framework (CARF) guidance and clarity for non-US brokers obligations for Form 1099-DA reporting

- 6050I reporting for anti-money laundering purposes

- Clarity on tax depositing rules (e.g. when does a day end for purposes of tax withholding, to ensure timely deposits with the IRS)

- Source, character, and tax withholding rates of blockchain transactions (e.g. staking income) for purposes of tax withholding on foreign persons and accessing tax treaty benefits

- Source and character of NFT transactions such as secondary sales and revenue sharing agreements (typically called royalties in the industry)

- Wash sale rules for crypto and other digital assets

- Other Form 1099 requirements that may apply to DeFi providers (e.g. Form 1099-MISC, NEC, or other form types for staking income, etc)

- State Form 1099 reporting requirements that will diverge from federal requirements

Who is Ledgible, How Can We Help

The Ledgible platform is built from the ground up to streamline digital asset tax information reporting and compliance. Ledgible ensures tax reporting compliance for digital assets for some of the largest financial institutions in the world, including top 5 US banks, investment firms with $1B+ AUM, and top 10 crypto exchanges. As a SOC 1 & 2 Type 2 Certified platform, Ledgible is the trusted provider of choice for digital asset tax data, calculations, and Form 1099 generation. We are ready to assist you in developing your fit-for-purpose tax reporting operating model. We customize our data collection, calculation, tracking, and reporting solution to fit your unique blockchain data and operating model needs. Integration with our partners ensures your compliance needs are covered in customer onboarding, tax withholding calculations, and annual reporting.

Disclaimer

This blog post does not constitute tax or legal advice nor does it constitute a tax or legal opinion. Independent tax and legal advice must be sought by our readers to assess their own circumstances against these final and future regulations and guidance. This blog is Ledgible’s first assessment at summarizing the impact of the final regulations as of December 27, 2024. This means that our assessment should, and will, change as differing interpretations are debated amongst industry working groups.