Ledgible Account

please use to the links below to sign in:

Digital Asset Tax Information Platform

for Institutions & Professionals

Ledgible makes digital assets Ledgible.

Accurate. Comprehensive. Ledgible.

Le[d]gible

Explore Our Solutions

tax information, accounting, and tokenization systems

The choice of leading institutions and enterprises across the digital asset and traditional finance industries

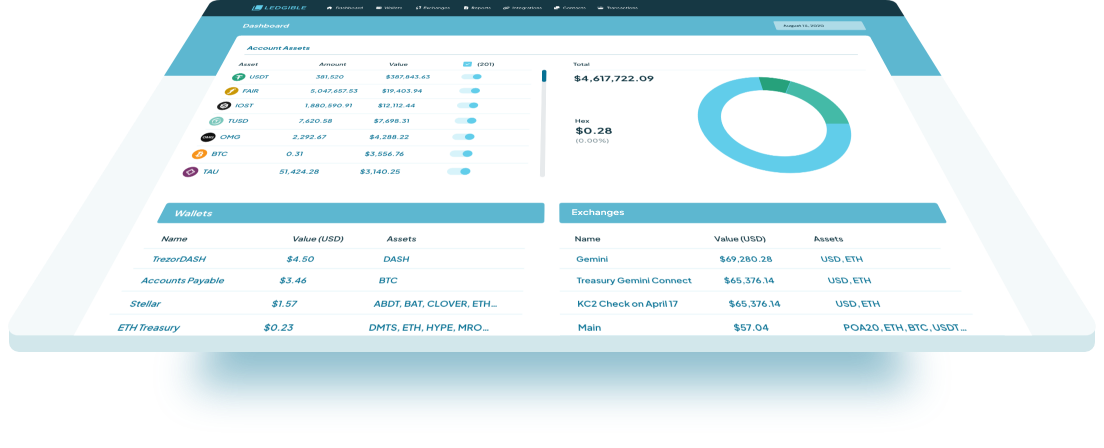

Managing digital asset tax information data has never been easier

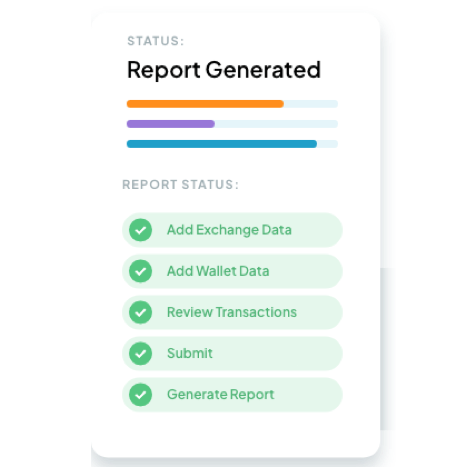

tax form process, for filing and tax information reporting

the most important crypto accounting stories.

Accounting for Enterprises and Institutions with Digital Assets

Ledgible Crypto Enterprise & Institutional Accounting takes the headache out of managing digital asset data. Whether you’re running month-end reporting, analyzing balances, managing crypto funds, or integrating with your existing accounting software like Advent Geneva, Netsuite, QuickBooks Online, Xero, Wall Street Concepts, SEI, Eagle, and so many more systems, Ledgible has you covered.

Explore the Latest Digital Asset Content

In addition to building industry-leading software solutions for cryptocurrencies and digital assets, the experts at Ledgible curate a knowledge base of learning content around cryptocurrencies. If you’re seeking to learn more about cryptocurrencies, digital asset accounting, or even understand the benefits of using particular exchanges or wallets, you can explore our knowledge base here.

Contact Our Team