Ledgible Account

please use to the links below to sign in:

Crypto Cost-Basis Accounting Software for Enterprises and Institutions

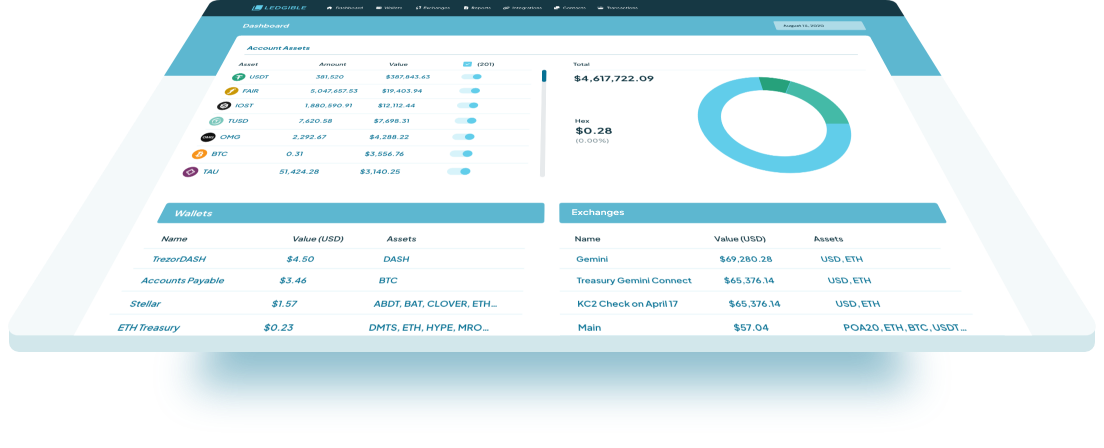

Enterprise & Institutional Crypto Accounting Made Simple

of on-chain cryptocurrency transactions filtered by wallet, asset, and date.

QuickBooks and Xero.

Ledgible Accounting allows you to add additional users to your account to help monitor your digital asset data. A user is added with a permission level that determines what they can access and edit. Setting up your team to account for cryptocurrency is simpler than ever with Ledgible.

Ledgible Accounting allows you to monitor your digital asset data over time through our asset table. Select from any previous or current date to get accurate pricing information for all assets on the specified date. Tracking crypto is made easy with Ledgible.

Ledgible allows you to create contacts for blockchain addresses that you exchange with frequently. By identifying these addresses you can better identify reoccurring transactions and ensure the crypto accounting process is as straightforward as can be.

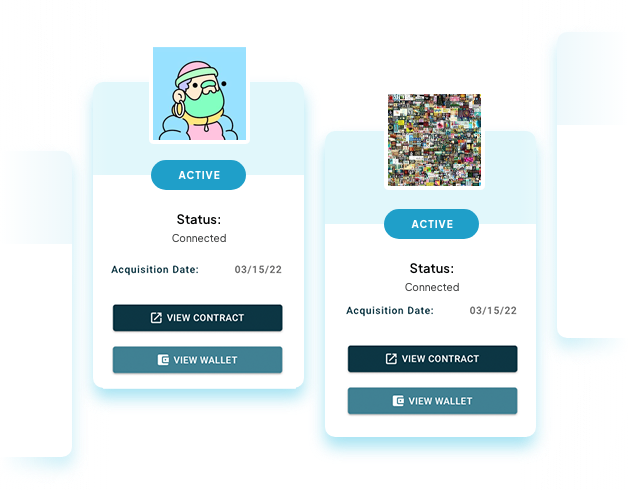

Ledgible's industry leading tax and accounting platform now has an exclusive NFT Suite, allowing you to monitor and track NFT activity across all supported wallets and chains in a single dashboard. Managing accounting for NFTs has never been easier.

Crypto accounting isn’t one-size-fits-all, especially when it comes to business and institutional operations. Get in touch with our client solutions specialists to determine the pricing plan that fits your needs. You can also get a Ledgible Accounting Free Trial by registering below.

Pricing criteria includes:

Account Users, Exchange Connections, Wallets, Transactions, General Ledger Integrations

Explore Our Solutions

Explore the Latest Crypto Content

Industry leading support for every accounting scenario

Ledgible maintains an industry leading knowledge base that walks you through every intricate scenario you might encounter in the crypto tax process. If we don’t have an article on our knowledge base for your exact question, we have knowledgeable support staff available 24/7 who work with users to solve any challenge they face.