Are you a crypto trader that's earned money on cryptocurrencies? This guide will take you through everything you need to know about filing and reporting on cryptocurrencies in the TurboTax DIY tax filing platform. While the world of cryptocurrency taxes might seem confusing, the good news is that Turbotax will be able to handle your cryptocurrency taxes through a simple integration with Ledgible. But first, let's walk through the basics of crypto tax filing with TurboTax.

Should you file DIY crypto taxes?

Chances are if you're a crypto trader, you're likely also a big proponent of doing things yourself and taking charge of your own financial situation. The only thing standing in the way of crypto traders looking to file their own crypto taxes is the IRS and it's confusing – to put it lightly – guidance on cryptocurrency tax and accounting.

However, solutions like Ledgible allow you to do your crypto taxes yourself and even automate the entire process, feeding directly into the TurboTax system. If you have a complex trading history in crypto, while Ledgible will be able to automatically calculate your gain/loss and cost basis data, there are potential tax scenarios you may face that necessitate a tax professional. Due to the IRS's inexact guidance on how to treat crypto for taxation, tax professionals may actually be able to further minimize the taxes you owe for crypto.

Reporting Cryptocurrency in TurboTax

TurboTax by Intuit is by far the most popular tax preparation software for DIY filers looking to get their taxes done with ease. Since it's so easy to use, its no wonder why it's used by about 60% of DIY filers. Luckily, TurboTax also understands the need for crypto tax reporting and has a section in their tax process where you can upload and account for cryptocurrency gains. In this part of TurboTax, you'll be able to upload forms from Ledgible to automate the process.

For crypto trading, the IRS considers cryptocurrencies the same as property, meaning that you're going to need to record the cost-basis and gain/loss for the assets you hold. The tricky part is you'll need to report all of this in USD, something that isn't necessarily straightforward when you're dealing with crypto, which is its own separate currency.

Gains and losses are going to be reported on Form 8949, which Ledgible produces for crypto trades.

Mining Income

Mining crypto is treated like income by the IRS, meaning that you're going to have to pay income tax on the income you make from mining. In essence, all mining is providing a service to the blockchain and in turn getting paid in cryptocurrency. This means that you'll need to report mining income as "Other Income" in TurboTax, which will be reported on the 1040 that TurboTax files. You can also report mining income as self-employment income on your Schedule C if you choose.

If you're making a significant amount of income through mining throughout the year, chances are you might also need to be paying estimated tax too. To learn more about estimated tax filing and the deadlines throughout the year, read out post on the topic here.

Integrating with TurboTax for Crypto

Filing crypto taxes with Ledgible and TurboTax is simple and can be done in 3 simple steps. We've included the three steps below, but you can read more about filing crypto taxes with TurboTax and Ledgible in our article here.

Step 1: Get Started in your TurboTax Account

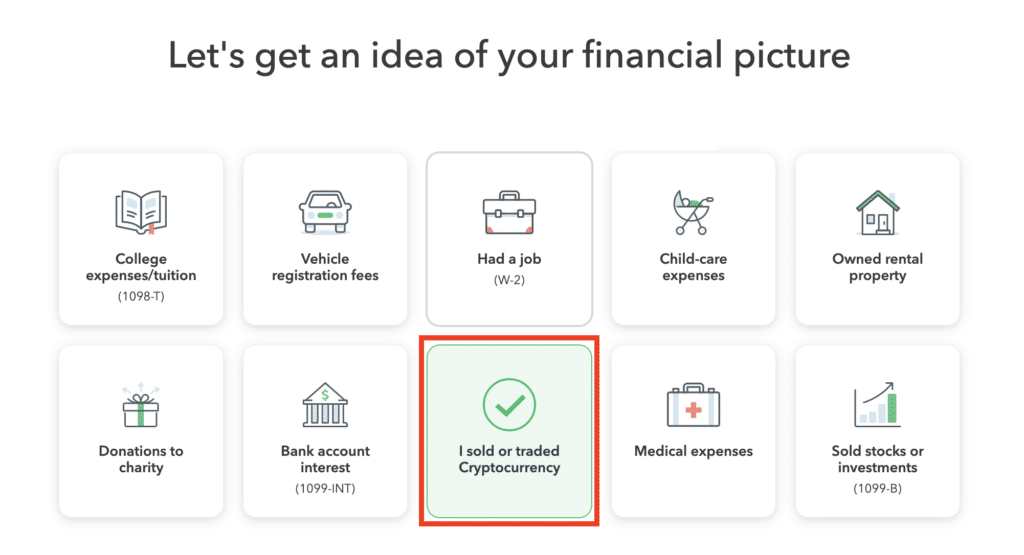

The first start to filing crypto taxes through TurboTax is getting logged into TurboTax and providing all of the necessary underlying tax information. As TurboTax works to gain a better understanding of your tax situation, you will find yourself on a screen that looks something like this:

Step 2: Click on the Cryptocurrency Section

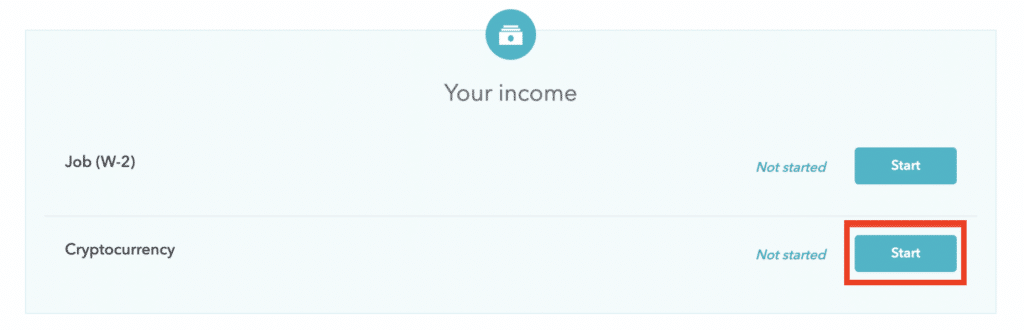

By selecting the option in the previous step about trading cryptocurrency, your TurboTax Income & Expenses dashboard should now be set up to report cryptocurrency. Your Income and Expenses tab should look something like this now:

On the off-chance that your income tab doesn't show the cryptocurrency option, it's likely that you might have missed something in a previous step - but no worries! You can add cryptocurrency here by clicking "Add more Income" in your Income and Expenses tab, then simply select cryptocurrency.

At this point, click the "Start" button in TurboTax, or if you've already been there before, it might say "Edit/Add". Clicking on this button will take you to the cryptocurrency section and allow you to start reporting your transactions.

Step 3: Navigating and Uploading to the Cryptocurrency Section of TurboTax

After clicking on the buttons from the previous step, Turbotax is likely going to ask you whether you traded or sold cryptocurrency in you tax year again. You'll want to answer "Yes" to this question again to make sure all of the necessary steps are followed.

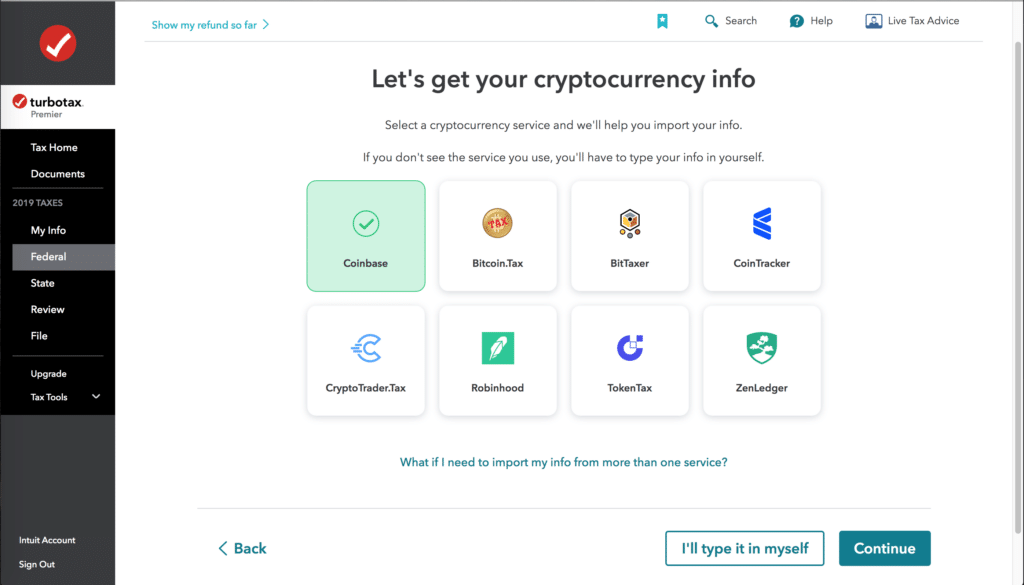

When you arrive at the cryptocurrency information section, you're going to see a screen that looks something like this:

On this screen, you're going to get the opportunity to input all of your trades and transfers from crypto in the past year.

"But what if I use multiple exchanges and don't know all of the transactions I made?"

This is a situation many if not most crypto users find themselves in during tax time. If this is you, Ledgible can help. Ledgible Crypto Tax allows filers to quickly (and securely) connect all of their wallets and exchanges and automatically generate the necessary tax reports, specifically for upload into TurboTax!

You can learn more about Ledgible Crypto Tax here.

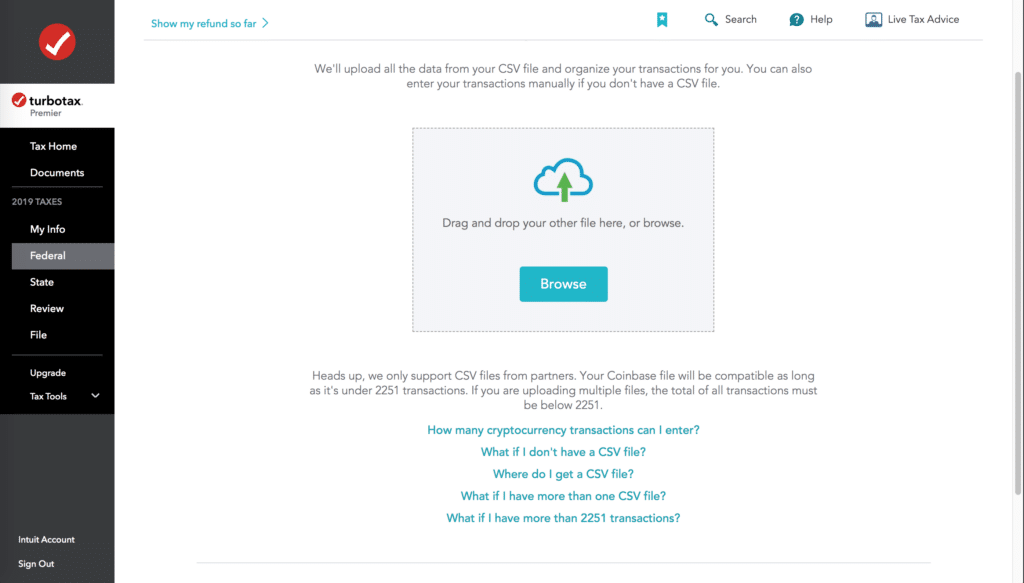

Once you use Ledgible to generate all of your reports, you can import your reports on the crypto screen in TurboTax. You'll land on a screen something like this: